The United Arab Emirates has established a reputation across the Middle East as one of the nations with the greatest number of free zones for conducting business. UAE, with its plethora of possibilities and advantages, has unquestionably drawn investors and entrepreneurs from all over the world.

In the United Arab Emirates, one of the most attractive aspects of establishing a business is exploring the different types of business structures and the advantages that come with them, especially Free Zone Limited Liability Companies (FZ LLC). In this blog, we will discuss what an LLC structure is, its advantages, and the distinctions between mainland and free zone structures, as well as how to set up your business with the structure of a FZ LLC in Dubai and other emirates, among other things.

Table of Contents

In a free zone, what exactly is a limited liability company?

In the United States, a free zone establishment (FZE) or a free zone company (FZC) is a limited liability business that is created in a free zone and regulated by the laws and regulations of that particular free zone.

In the free zone business environment, there are two types of company structures available: the free zone establishment limited liability company (FZE LLC) and the free zone corporation limited liability company (FZCO LLC). The distinguishing characteristic of FZ LLC is that it only has one shareholder, as opposed to FZCO LLC, which may have many owners.

Advantages of forming a limited liability company in a free zone:

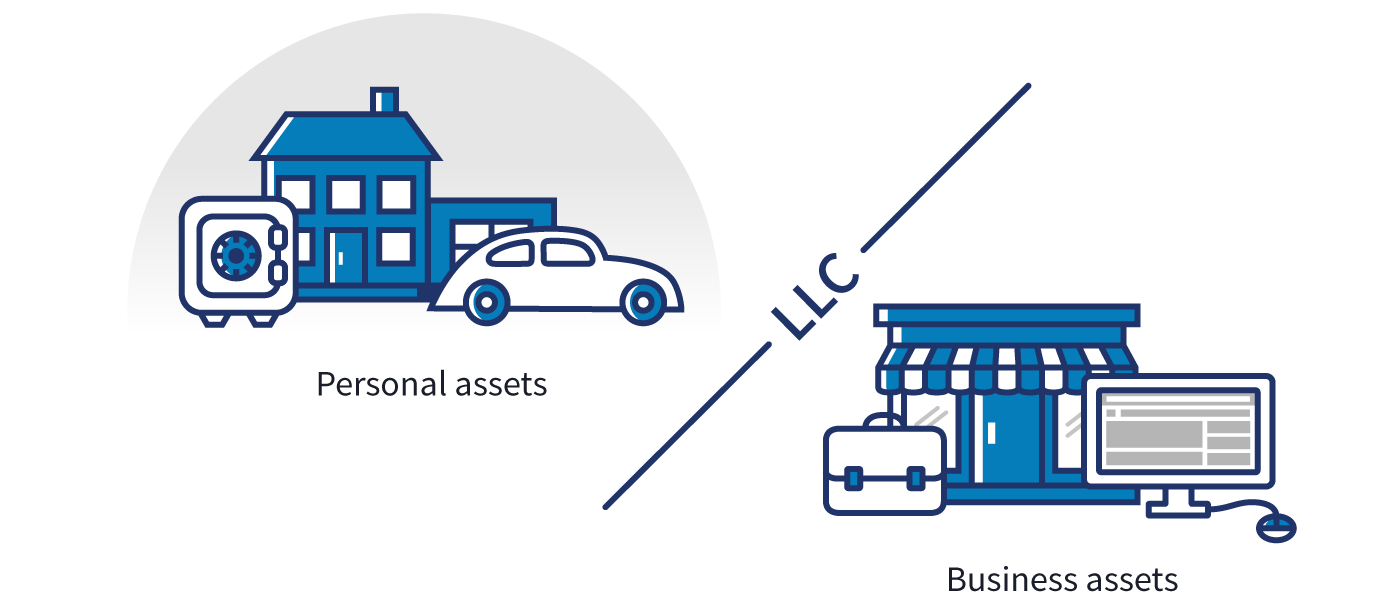

One of the most significant advantages of using an LLC company structure is that it protects the shareholders of the firm from any liabilities, debt, and other financial obligations that may arise as a result of the company’s business activities.

A free zone structure is a kind of free zone structure. Additionally, forming a limited liability company in Dubai or another emirate would imply that you would only be liable for damages up to the amount of money that you have put in your business, and not any more. There are a variety of additional advantages to forming an LLC in a free zone, including the following:

100 percent foreign ownership: Foreign entrepreneurs who control their whole business without the involvement of a local partner stand to gain from this arrangement. You will, however, need the assistance of a local sponsor, to whom you will be obliged to pay an annual fee that has been mutually agreed upon.

Repatriation of capital and earnings in full: Companies operating in free zones are permitted to repatriate 100% of their profits to their home nation. Allowing them to transfer 100 percent of their wealth back to their place of origin without any restrictions is a significant step forward.

There will be no personal, company, or income tax.

All import and export taxes are exempted from payment.

Convenient recruiting and cost-effective staff management

Variety of business activity: Free zones provide a platform for a diverse variety of commercial operations. Individuals will find it more easier to connect and network as a result of this.

There are a plethora of amenities available: There are many different types of facilities from which to select for your company setting. From flexi-desk spaces to conventional offices and even warehouse facilities, there is something for everyone here.

UAE residency visa for three years is available: LLC business registration and licencing are available:

When contemplating an LLC structure in the UAE, unlike the mainland, you have the option to choose an LLC structure regardless of the kind of licence you have, which is advantageous. The security of having an LLC structure will continue to shield you from liability risks, as opposed to when you operate as a sole proprietorship, when you may lose all you own completely. The following are the kinds of licences that may be obtained via an LLC structure:

Obtaining a Professional License

License for Commercial Use

Licence de l’industrie

A FZ LLC structure is appropriate for customers who want to offer services or who want to acquire a professional licence in their field. The ability to do business in local markets while operating under the protection of a professional licence in a free zone alleviates the worry of debts or liabilities that may follow you into your next venture.

In Dubai and the other emirates, there are about 45 free zones that provide a structure similar to that of an LLC. According to the nature of your firm, including its commercial operations, the type of its facility, and the number of visas issued, the best free zone for your LLC structure would be determined by many factors, including the location of your company.

Formation of limited liability companies (LLCs) on the mainland and in the free zone:

Limited liability company (LLC) formations are most often performed on the mainland. In order for mainland businesses with LLC structures to be formed, 51 percent of the company’s ownership must be transferred to a local sponsor, with the remaining 49 percent held by the foreign expat.

This is not the case, however, with the free zone LLC business structure, which provides the expat with the option to control 100 percent of the firm without the requirement for a sponsor from the local community. If you want to have more partners in an LLC structure in a free zone, you will have the option to select how your shares are split, and you will not be required to employ any more people in your company that you do not need.

It is important to note that there is no difference in protection between mainland LLC businesses and free zone LLC companies. You will still have the same level of protection that an LLC structure provides. However, LLC structures are not present in all free zones.

Generis Global can help you get started in the world of business.

Getting your corporation up and running on your own may be a time-consuming and demanding endeavour. Several considerations and procedures must be taken into consideration when establishing a company in the United Arab Emirates, and the process is complicated.