In this uncertain world of globalisation and rising markets, Dubai’s economic and cultural development is supported by a legal and regulatory framework that has matured sufficiently to encourage substantial local and international entrepreneurship and is still evolving. The adequacy of the legal and regulatory framework in the particular local jurisdiction is a frequent subject when determining where to do business. The willingness of international enterprises to establish and operate in Dubai, as well as the success of local Dubai businesses, demonstrates Dubai’s strong and dynamic legal and regulatory environment.

Get Started With UAEThe UAE Federal Constitution

The United Arab Emirates (UAE) was founded in 1971 as a federation of seven emirates: Dubai, Abu Dhabi, Ajman, Fujairah, Ras Al Khaimah, Sharjah, and Umm Al Quwain. The federal constitution of the United Arab Emirates establishes a division of powers between the federal government and the governments of each of the emirates. Dubai is governed by UAE federal legislation, yet it has the authority to manage its own internal affairs and has several additional exclusive privileges.

The Foundations of the Legal System

The legal system in Dubai is based on both civil law principles (which are largely inspired by Egyptian law) and Islamic Sharia law, with the latter serving as the guiding principle and source of law.

Legislation in Dubai and other civil law countries is usually organised into a few major codes that set out broad principles of law and a lot of subsidiary legislation. Over the last 30 years, the entry of regional and worldwide commercial businesses to Dubai and the UAE has led in the establishment of a growing and increasingly comprehensive body of federal laws in the form of federal codes of law.

The most essential and fundamental elements of law, including as civil, commercial, civil process, corporations, intellectual property, immigration, marine, industrial, banking, and employment law, are covered by federal codes of law that apply in Dubai and the other emirates. Many of the laws passed by the Ruler of Dubai, on the other hand, are administrative in nature, such as the formation and operation of government-affiliated businesses.

The Court System

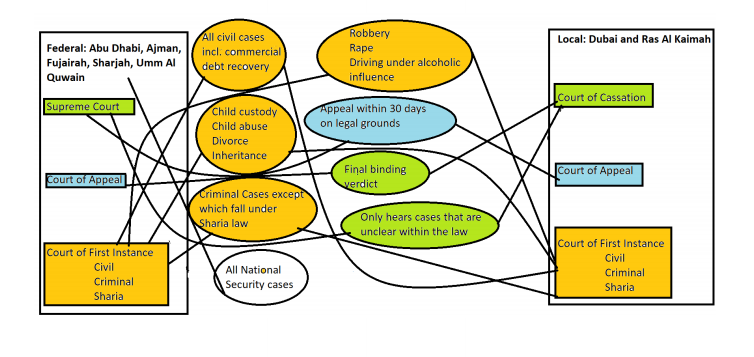

Despite the fact that the UAE federal constitution allows each emirate to have its own legal authority, all emirates except Dubai and Ras Al Khaimah have joined the UAE Federal Judicial Authority. Dubai has kept its own autonomous courts (and judges) separate from the UAE Federal Judicial Authority. Where federal legislation is absent or silent, Dubai’s courts will initially use federal statutes such as the Companies Law or the Civil Code, as well as laws and decrees passed by the Ruler of Dubai.

UAE Court Structure

A Court of First Instance, a Court of Appeal, and a Court of Cassation make up Dubai’s legal system. There is a civil division, a criminal division, and a Shari’a division in each of these courts. The civil division handles most civil claims, the criminal division hears most criminal cases in Dubai, and the Sharia division hears civil cases for Muslims, the majority of which are related to family concerns including divorce and inheritance. Non-Muslims in Dubai are expected to follow Sharia law and comport themselves accordingly.

It’s also worth noting that the Dubai courts operate in Arabic, thus legal representation necessitates not just legal advocates who are officially licenced to appear before the courts, but also those who are fluent in Arabic.

Free Zones

Any legal or regulatory framework is only as good as its ability to adapt and evolve as the world changes and local and international business requirements become more sophisticated. In terms of law and regulation, there have been some significant advances in Dubai, most notably the creation of the various free zones that have, to varied degrees, distinct rules and regulations than non-free zone areas. The Dubai International Financial Centre (DIFC), the Jebel Ali Free Zone, and Dubai Media City are some of the more well-known free zones in Dubai.

The conditions for doing business in free zones are extremely appealing, with a 100% success rate. Foreign ownership of companies is permitted (compared to 49% for most companies created outside the free zones), there are tax breaks, no restrictions on capital and profit repatriation, and no currency restrictions or import taxes.

Free zones have played a critical role in establishing Dubai’s reputation as a desirable location for business.

Get Started With UAE

The Dubai International Financial Centre

The DIFC is a world-class “onshore” financial centre that was founded to bridge the gap between the world’s major financial centres. It was created to serve as a regional capital and investment gateway as well as a recognised hub for institutional finance. The DIFC was established in 2004 and has its own set of laws and regulations, as well as its own courts and arbitration centre. It is exempt from the UAE’s civil and commercial regulations, but remains subject to UAE criminal law. The DIFC has enacted legislation to manage the day-to-day requirements and activities of financial institutions, businesses, and individuals.

The laws are based on best practises from the world’s main financial jurisdictions, and they represent the finest of international financial and commercial law. The laws are built on principles, allowing for the establishment of secondary legislation like regulations and rules. Laws have been passed that effectively create a “commercial code.” The DIFC Authority administers these laws, which include the Companies Law, Contract Law, Arbitration Law, and Insolvency Law, among others. Other laws in the DIFC deal with the application of civil commercial laws. The Dubai Financial Services Authority administers the Regulatory Law, Markets Law, Data Protection Law, and Law Regulating Islamic Financial Business, which are all part of the financial services legislation (the DFSA).

International financial institutions and enterprises have rushed to the DIFC, drawn by the DIFC’s comprehensive and, more crucially, well-known laws and regulations. The DFSA’s tough stance on money laundering is also reassuring to the international community, demonstrating that Dubai is serious about its ethical, social, and business duties.

The DIFC is also home to a major international stock exchange that has grown rapidly in a short period of time, having just been open for a little more than three years. The exchange is currently known as NASDAQ Dubai, and it has evolved from an equity-focused market to one that now trades structured financial products including, most recently, equity derivatives. The public is now being consulted on changes to NASDAQ Dubai’s listing regulations, demonstrating a mature willingness to address market participants’ concerns. Given the exchange’s brief history, there are a healthy number of issuers listed on NASDAQ Dubai who enjoy adequate liquidity and trading volumes. The number one exchange for Sukuk, or Islamic bonds, is NASDAQ Dubai.

Structuring and licensing for international businesses wishing to do business in Dubai

International businesses wishing to do business in Dubai can incorporate or register a local entity under the Companies Law or the Civil Code, register a branch or representative office of a foreign company, or enter into a commercial agency relationship with a UAE national, in addition to setting up shop in one of Dubai’s numerous free zones. Other than setting up in a free zone, each of these business structures requires varying degrees of participation from UAE nationals – for example, a company incorporated under the Companies Law must have 51 percent of its share capital held by UAE nationals, and branch and representative offices must appoint a UAE national to sponsor.

In the United Arab Emirates and Dubai, business licence is very significant. Any person seeking to conduct business in Dubai (other than through a licenced agency) must get a licence, which limits the scope of the licensee’s activity. Certain sectors of the UAE and Dubai economy, like most other jurisdictions, are subject to more strict licencing regulations than others. International enterprises intending to conduct banking or most other financial services in Dubai and outside the DIFC, for example, must obtain a licence from the UAE Central Bank, which is closely regulated.

Tax Regulations

In the United Arab Emirates, there is no federal company or income tax (except on oil companies and foreign banks). The Dubai Income Tax Ordinance of 1969 established a local income tax; however, the tax has yet to be applied, and it is known that there are no plans to do so. In addition, free zone entities are eligible for a variety of tax breaks. In Dubai and the United Arab Emirates, there is no VAT or sales tax. There are no limits on the remittance of profits or the repatriation of capital, and overseas trade is essentially unrestricted.

Corporate governance

Dubai has recognised the importance of developing and encouraging excellent corporate governance practises in the Middle East, which can only aid in attracting foreign direct investment. Hawkamah Corporate Governance Institute, the UAE’s first of its kind, was founded with the goal of supporting Middle Eastern countries and businesses in developing and implementing solid and globally connected corporate governance frameworks. Dubai’s commitment to promoting business transparency, strong corporate governance, and anti-money laundering policies is a model for the Middle East area and a major draw for international investment.

Law Enforcement

Dubai’s laws are carefully enforced. It is a major crime in Dubai to possess, consume, acquire, or sell any drug (save for most prescription medications, which tourists should confirm are permitted in Dubai before to arrival). The UAE also has a zero-tolerance policy for driving while intoxicated. If you’re discovered driving with even a trace of alcohol in your system, you could face fines, incarceration, even deportation. Despite the fact that Dubai is an open and accepting culture, tourists should be aware of Muslim attire and behaviour, which are generally more conservative than those in the West.

Legal Representation

It is simple to find legal representation in Dubai. Dubai is home to a diverse range of regional and international law firms, with many of the major international companies choosing to base themselves in the DIFC.

Conclusion

In a relatively short period of time, Dubai has established a comprehensive and dynamic legal and regulatory framework that provides foreign enterprises and investors with tremendous peace of mind when selecting to invest or conduct business in Dubai. Local Dubai enterprises can also thrive in a well-regulated environment thanks to the framework. Dubai’s ruler and government have understood that in today’s fast-paced world, a flexible approach to law and regulation is essential. This has been a major contributor to Dubai’s continuous growth and prosperity.

Get Started With UAE