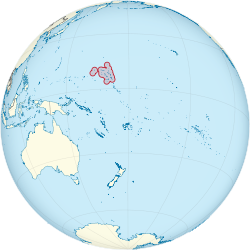

Republic of the Marshall Islands Aolepān Aorōkin Ṃajeḷ (Marshallese) | |

|---|---|

| Motto: "Jepilpilin ke ejukaan" "Accomplishment through joint effort" | |

| Anthem: "Forever Marshall Islands" | |

| |

| Status | UN member state under a Compact of Free Association with the United States |

| Capital and largest city | Majuro 7°7′N 171°4′E / 7.117°N 171.067°E |

| Official languages | |

| Ethnic groups (2021) |

|

| Religion (2021) |

|

| Demonym(s) | Marshallese |

| Government | Unitary parliamentary republic with an executive presidency |

| Hilda Heine | |

| Brenson S. Wase | |

| Legislature | Nitijela |

| Independence from the United States | |

Self-government | May 1, 1979 |

| October 21, 1986 | |

| Area | |

Total | 181.43 km2 (70.05 sq mi) (189th) |

Water (%) | n/a (negligible) |

| Population | |

2021 census | 42,418 |

Density | 233/km2 (603.5/sq mi) (47th) |

| GDP (PPP) | 2019 estimate |

Total | $215 million |

Per capita | $3,789 |

| GDP (nominal) | 2019 estimate |

Total | $220 million |

Per capita | $3,866 |

| HDI (2022) | high (102nd) |

| Currency | United States dollar (USD) |

| Time zone | UTC+12 (MHT) |

Summer (DST) | not observed |

| Date format | MM/DD/YYYY |

| Calling code | +692 |

| ISO 3166 code | MH |

| Internet TLD | .mh |

Table of Contents

Introduction to Consumer Protections in Insurance

Consumer protections in insurance contracts play a crucial role in ensuring that policyholders in the Marshall Islands are treated fairly and transparently. These protections are designed to uphold the rights of consumers, allowing them to navigate the complexities of insurance policies with a better understanding of their entitlements and obligations. Given the intricate nature of insurance agreements, it is essential that consumers are provided with adequate safeguards that promote both oversight and accountability within the insurance sector.

The importance of these consumer protection measures cannot be overstated. They are paramount in fostering trust between consumers and insurance companies, as they help to mitigate potential disputes arising from policy interpretation and enforcement. By establishing clear guidelines, consumers can engage with their insurance contracts with confidence, knowing that there are established frameworks in place to protect their interests. This is particularly significant in a market where individuals may lack familiarity with legal jargon and industry practices.

Furthermore, awareness of consumer protections ensures that policyholders are well-informed about their rights. For instance, understanding the required disclosures that insurance providers must offer allows consumers to make educated decisions when selecting coverage options. Such knowledge empowers policyholders to advocate for their needs should conflicts arise. Additionally, knowing the mechanisms available for dispute resolution can enhance consumer confidence in the insurance industry overall.

As we delve deeper into the various aspects of consumer protections in insurance contracts, we will explore policy requirements, mandated disclosures, and the processes to address disputes. Each of these elements plays a vital role in reinforcing the pillars of fairness and transparency within the insurance landscape of the Marshall Islands, ultimately ensuring that consumers are not left vulnerable in their financial dealings.

Legal Framework Governing Insurance in the Marshall Islands

The legal framework that governs insurance practices in the Marshall Islands is primarily derived from statutory laws enacted by the government and regulatory authorities. The key legal document is the Insurance Act, which sets forth the foundational guidelines for the operation and management of insurance companies within the jurisdiction. This Act establishes the necessary requirements for licensing insurers and outlines the standards for their financial solvency, ensuring that policyholders are protected against the risk of an insurer defaulting on its obligations.

In addition to the Insurance Act, other regulations complement the statutory framework, addressing various aspects of insurance operations. The Financial Institutions Act plays a significant role by regulating the activities of financial institutions, including insurance providers. This legislation mandates transparency in financial reporting and operational practices, thereby fostering consumer confidence in the insurance sector. Furthermore, the Marshall Islands Insurance Authority is tasked with enforcing compliance with these regulations, ensuring that consumers’ rights are prioritized and protected.

Another vital aspect of the legal framework is the establishment of consumer protection measures. These measures are designed to uphold the rights of policyholders, ensuring they are treated fairly and equitably by insurers. For instance, regulations may dictate the disclosure requirements that insurance companies must fulfill, ensuring that customers are adequately informed about the terms and conditions of their policies. Additionally, mechanisms are in place for the resolution of disputes between insurers and policyholders, further enhancing consumer protections. Collectively, these laws contribute to a fair marketplace where insurance transactions can be conducted with integrity and accountability, ultimately benefiting the consumers in the Marshall Islands.

Requirements for Policy Transparency

In the Marshall Islands, the framework governing insurance contracts places significant emphasis on the requirement for policy transparency. Insurance companies are mandated to present their products in a manner that is clear and comprehensible, thereby ensuring that consumers can make informed choices. This emphasis on clarity is not merely a regulatory formality; it is a fundamental aspect of consumer protection aimed at preventing misunderstandings and disputes that may arise post-purchase.

One of the crucial components of policy transparency is the use of unambiguous language throughout insurance contracts. Insurance policies often contain complex terminology that can be difficult for the average consumer to understand. Therefore, legislation encourages insurers to utilize straightforward language that accurately reflects the terms and conditions of the coverage provided. By demystifying the language used in contracts, policyholders can better assess their coverage and the implications of their decisions, which ultimately empowers them in the marketplace.

Moreover, it is essential for insurance policies to comprehensively outline all terms and conditions associated with the coverage. This includes details about premiums, deductibles, limits of liability, exclusions, and the claims process. When such information is prominently displayed, it not only enhances transparency but also allows consumers to compare different policies effectively. This comparability is vital, as it assists buyers in discerning which insurance product best suits their individual needs, fostering a more competitive environment among insurers.

Transparency in insurance contracts directly contributes to consumer trust and confidence. When insurance companies adhere to these requirements, they help mitigate the risk of disputes and enhance customer satisfaction. As a result, consumers in the Marshall Islands benefit from a deeper understanding of their insurance contracts, enabling them to make educated decisions tailored to their specific circumstances.

Disclosure Obligations of Insurance Providers

Insurance providers play a crucial role in ensuring that consumers are well-informed about the products they are purchasing. In the Marshall Islands, these companies are mandated to adhere to specific disclosure obligations when presenting their insurance contracts. Such obligations are primarily aimed at providing transparency and enabling policyholders to make informed decisions.

One of the essential elements of these disclosure obligations is the requirement to provide comprehensive details regarding the coverage included in the insurance policy. Providers must clearly articulate what risks are covered and to what extent, ensuring that policyholders understand the limits of their coverage. Additionally, important information regarding premiums—such as the amount, payment schedule, and any applicable discounts—should be transparently communicated to potential clients. This transparency helps consumers evaluate whether the policy aligns with their financial capabilities and needs.

Furthermore, insurance providers must disclose any exclusions or limitations that may apply to the policy. This information is vital as it outlines the circumstances under which claims may not be honored, thereby preventing misunderstandings that could arise during the claims process. Properly informing consumers about these critical terms allows individuals to weigh the benefits of a policy against its limitations, leading to smarter purchase decisions.

Other critical terms that should be disclosed include renewal conditions, potential premium adjustments, and the claims process. This comprehensive approach to disclosure enables consumers not only to understand the product in question but also to be aware of their rights and obligations under the insurance contract. By effectively fulfilling these disclosure obligations, insurance providers empower consumers in the Marshall Islands to navigate the complexities of insurance products with confidence.

Consumer Rights under Insurance Contracts

In the Marshall Islands, policyholders are endowed with specific rights that are designed to safeguard their interests within the framework of insurance contracts. These rights are fundamental in ensuring a fair relationship between consumers and insurance providers. Understanding these rights is key to navigating the insurance landscape effectively.

One of the primary rights of policyholders is related to claims processing. When a claim is filed, the insurer is obligated to handle it promptly and fairly. This means that policyholders have the right to receive timely updates regarding the status of their claims. Any unreasonable delays or unjustified denials can be challenged, ensuring that consumers are not left in a lurch during stressful times. Thus, efficient claims processing mechanisms serve as a crucial aspect of consumer protection.

Another critical right is the ability to make adjustments to premiums. Consumers have the right to understand how their premiums are calculated and are entitled to request adjustments based on life changes or risk factors that may alter their coverage needs. This ensures that policyholders are not locked into fees that no longer align with their financial situation or risk profile, contributing to a fairer pricing structure.

Moreover, policyholders in the Marshall Islands have the right to choose their coverage based on personal needs. Whether it is selecting additional coverage options or modifying existing ones, consumers can tailor their insurance policies to better match their circumstances. This choice is essential to empower individuals and families to make informed decisions that best suit their financial and personal needs.

These rights collectively strengthen consumer protection within the insurance sector, fostering a sense of trust between policyholders and insurers. By recognizing and exercising these rights, consumers in the Marshall Islands can better navigate insurance contracts while safeguarding their interests against potential pitfalls.

Disputing Insurance Claims: Policyholder Options

In the Marshall Islands, policyholders facing disputes over insurance claims have access to a variety of mechanisms to seek resolution. These options are crucial for ensuring that consumers can effectively challenge what they perceive to be unfair treatment by insurance providers. Among the most common methods available are formal complaint processes, mediation, arbitration, and legal recourse.

The formal complaint process serves as the initial step where policyholders can file their grievances directly with the insurance company. Insurers are usually obligated to have a defined procedure for addressing complaints, allowing policyholders to articulate their concerns clearly. This process can sometimes lead to a quicker and more cost-effective resolution without resorting to more formal settings.

Should a formal complaint not yield satisfactory results, mediation is an alternative route. Mediation involves a neutral third party who facilitates discussions between the insurer and the policyholder. This method aims to foster mutual understanding and can be less adversarial compared to traditional legal disputes. Mediation is particularly appealing due to its flexibility and the control it affords parties over the outcome.

If mediation fails, arbitration may be the next viable option. Similar to mediation, arbitration involves a neutral third-party arbitrator who examines the case and renders a binding decision, which both parties are obligated to adhere to. This option often provides a more structured setting than mediation but remains generally less formal than litigation.

Legal recourse is available for those who find that their claims remain unresolved through earlier methods. Policyholders can pursue lawsuits in applicable jurisdictions, allowing them to argue their case in court. Access to legal professionals can enhance the policyholder’s understanding of their rights and potentially strengthen the case for the assurance of fair treatment.

Having clear dispute resolution options is vital for policyholders to protect their interests and ensure that insurance providers operate transparently and fairly. Understanding these mechanisms empowers consumers, allowing them to navigate disputes with confidence.

Role of Regulatory Bodies in Consumer Protection

The regulatory framework in the Marshall Islands plays a pivotal role in ensuring consumer protection within the insurance sector. Various governmental organizations, notably the Ministry of Finance and the Insurance Commission, oversee the practices of insurance providers. These entities are tasked with enforcing compliance with consumer protection laws, which serve to safeguard the rights of policyholders and ensure that insurance contracts are transparent and fair.

One of the primary functions of these regulatory bodies is to monitor insurance companies to ensure they adhere to established legal standards. This oversight includes reviewing policy documentation, auditing financial practices, and ensuring that companies maintain adequate reserves to meet their obligations to policyholders. By enforcing strict compliance, regulatory bodies can deter malpractice and protect consumers from unjust treatment in the insurance marketplace.

Moreover, regulatory bodies in the Marshall Islands are pivotal in resolving disputes that may arise between consumers and insurers. They facilitate complaints handling processes, allowing consumers to report grievances about unfair practices or inadequate services. This mechanism not only helps consumers seek remedy but also aids in identifying systemic issues within the insurance sector that may need regulatory intervention.

Additionally, the promotion of consumer education is a fundamental initiative undertaken by these organizations. Through various campaigns, workshops, and informational materials, regulatory bodies work to enhance the understanding of insurance contracts and the rights of consumers. By empowering consumers with knowledge, they can make more informed decisions, fostering greater confidence in the insurance system.

Ultimately, effective regulation is crucial for nurturing a healthy insurance market in the Marshall Islands, ensuring that consumer protection remains a top priority while also promoting trust between policyholders and insurers.

Case Studies: Consumer Protection in Action

In the realm of insurance, consumer protections are paramount to ensure that policyholders’ rights are upheld. Several case studies from the Marshall Islands demonstrate the effectiveness of existing legal frameworks and consumer protection mechanisms, highlighting real-world instances where these safeguards have successfully been enforced.

One notable case involved a local resident who faced challenges when filing a claim with their insurance provider after a significant loss due to flooding. The individual initially encountered resistance from the insurer, which sought to deny the claim based on technicalities. However, local consumer protection advocates became involved, leveraging the provisions of the Insurance Act designed to protect consumers. With their assistance, the resident was able to navigate the complexity of the claims process, resulting in the insurance company honoring the claim and providing compensation for the losses incurred. This case illustrates how regulatory structures can empower consumers and promote accountability among insurers.

Another instance occurred when a small business sought to claim damages following a fire incident. Despite having a valid policy, the insurer attempted to minimize the payout by citing vague policy language. The business owner, aware of their rights under the contractual agreement, asserted their claims, subsequently attracting the attention of the Insurance Commission. This body stepped in to mediate, clarifying consumer rights and ensuring that the business received a fair settlement, thereby reinforcing the importance of transparency and consumer knowledge in insurance contracts.

These case studies exemplify the critical role that consumer protections play in the insurance landscape of the Marshall Islands. They underscore the importance of not only having robust laws in place but also ensuring that consumers are well-informed about their rights and the mechanisms available to them for redress. By maintaining vigilance and advocating for fair treatment, policyholders can safeguard their interests and achieve positive outcomes when faced with disputes over insurance contracts.

Conclusion and Future Outlook

Consumer protections in insurance contracts within the Marshall Islands represent a critical element in safeguarding policyholders’ interests. The previous sections of this blog post illustrated the framework that governs these protections, highlighting the obligations of insurers and the rights of consumers. This bilateral relationship is fundamental in ensuring that policyholders can navigate the complexities of insurance contracts with confidence.

As the insurance industry continues to evolve, it is essential for regulators to remain vigilant in their oversight to maintain robust consumer protections. The dynamic nature of the market, driven by technological advancements and changing consumer expectations, necessitates periodic review and reform of existing regulations. Enhancements in transparency, clearer disclosure requirements, and improved channels for consumer complaints are essential areas where regulators could focus their efforts. This evolution not only supports the immediate needs of consumers but also fosters a more stable and trustworthy insurance sector.

Furthermore, as global standards in consumer protections continue to develop, the Marshall Islands could benefit from considering the adoption of these best practices. International cooperation and the integration of global regulatory frameworks could significantly bolster the local insurance landscape, enabling policyholders to enjoy protections that meet or exceed those found in other jurisdictions. This might include the introduction of ombudsman services to address disputes or the implementation of mandatory insurance education programs to empower consumers.

In summary, while the current framework for consumer protections in the Marshall Islands provides a solid foundation, ongoing commitment to reform and enhancement is crucial. With proactive measures and a focus on consumer needs, the future landscape of insurance in the Marshall Islands can become more secure and responsive for policyholders, ensuring their rights are upheld and their interests protected.