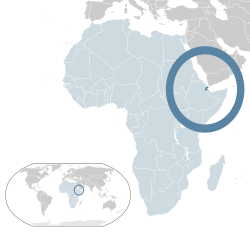

Republic of Djibouti | |

|---|---|

| Motto: Midnimo, Sinnaan, Nabad (Somali) Inkittiino, Qeedala, Wagari (Afar) Unité, Égalité, Paix (French) اتحاد، مساواة، سلام (Arabic) Unity, Equality, Peace (English) | |

| Anthem: Djibouti | |

| Capital and largest city | Djibouti City 11°36′N 43°10′E / 11.600°N 43.167°E |

| Official languages | |

| National languages | |

| Ethnic groups | |

| Religion | 94% Islam (official) 6% Christianity |

| Demonym(s) | Djiboutian |

| Government | Unitary dominant-party presidential republic under a hereditary dictatorship |

| Ismaïl Omar Guelleh | |

| Abdoulkader Kamil Mohamed | |

| Legislature | National Assembly |

| Formation | |

| 12 May 1862 | |

| 20 May 1883 | |

| 5 July 1967 | |

Independence from France | 27 June 1977 |

| 20 September 1977 | |

| 4 September 1992 | |

| Area | |

Total | 23,200 km2 (9,000 sq mi) (146th) |

Water (%) | 0.09 (20 km² / 7.7 sq mi) |

| Population | |

2024 census | 1,066,809 |

Density | 46.0/km2 (119.1/sq mi) (168th) |

| GDP (PPP) | 2023 estimate |

Total | |

Per capita | |

| GDP (nominal) | 2023 estimate |

Total | |

Per capita | |

| Gini (2017) | medium inequality |

| HDI (2021) | low (171st) |

| Currency | Djiboutian franc (DJF) |

| Time zone | UTC+3 (EAT) |

| Calling code | +253 |

| ISO 3166 code | DJ |

| Internet TLD | .dj |

Table of Contents

Introduction to Djibouti’s Business Environment

Djibouti, strategically located at the crossroads of the Red Sea and the Gulf of Aden, serves as a crucial gateway for international trade and commerce within the Horn of Africa. This unique geographical positioning provides businesses with access to key markets in the Middle East, Africa, and beyond, making Djibouti an attractive destination for entrepreneurs and investors. The nation’s well-established infrastructure, including the Port of Djibouti, facilitates deep-water access for shipping lines, thereby enhancing logistical efficiency and connectivity to global trade routes.

The economic landscape of Djibouti is shaped by various factors, including its service-oriented economy, which predominantly relies on trade, logistics, and port services. The government is keen to diversify its economy through investments in sectors such as renewable energy, tourism, and telecommunications. With a growing emphasis on private sector involvement, Djibouti offers numerous opportunities for startups and established businesses alike. The economic conditions are further bolstered by a favorable demographic profile, with a young population eager to contribute to the nation’s economic development.

Moreover, Djibouti’s government has made concerted efforts to attract foreign investment by implementing a series of economic reforms and creating a business-friendly regulatory framework. Initiatives such as tax incentives, free trade zones, and streamlined processes for business registration are designed to promote entrepreneurship and ease the challenges faced by foreign investors. Understanding this evolving business environment is crucial for anyone looking to start a business in Djibouti, especially as these conditions provide a solid foundation for establishing a profitable venture.

In order to successfully navigate the opportunities within Djibouti’s burgeoning market, a clear comprehension of the legal framework governing business operations is essential. This guide aims to provide insights into the legal considerations important for new businesses in Djibouti, ensuring that entrepreneurs are well equipped to embark on their entrepreneurial journey.

Understanding Djibouti’s Legal Framework for Businesses

The legal framework governing businesses in Djibouti is a vital aspect for entrepreneurs to understand as they embark on their business endeavors. Established primarily through the Commercial Code and various specific regulations, this framework sets the foundation for the formation and operation of businesses in the country. Entrepreneurs must navigate through these laws to ensure compliance and avoid potential legal pitfalls.

The Djibouti Chamber of Commerce plays a significant role in this legal landscape. It acts as a support system for businesses, facilitating registration processes and providing resources that promote business development. Furthermore, the Chamber assists entrepreneurs in understanding the regulatory requirements they must adhere to, reinforcing the importance of legal compliance in maintaining a viable operation.

In addition to the Chamber of Commerce, various government agencies are tasked with overseeing business activities in Djibouti. These agencies enforce regulations that relate to taxation, labor laws, environmental protection, and licensing. It is imperative that business owners familiarize themselves with these agencies and their respective regulations to ensure that their business operations align with national laws. Moreover, failure to comply with these legal standards can result in penalties, including fines or even the cessation of business activities.

Understanding the legal framework not only aids in establishing a business but also promotes a healthy business environment by fostering fair practices and competition. The laws and regulations in Djibouti are designed to support responsible entrepreneurship while protecting consumer rights and maintaining economic stability. Through diligent research and adherence to legal requirements, entrepreneurs can successfully navigate Djibouti’s business landscape, paving the way for growth and sustainability.

The Business Setup Process in Djibouti

Starting a business in Djibouti involves a well-defined process that is crucial for compliance with local laws and regulations. Initially, entrepreneurs must determine the appropriate business structure. The available options include sole proprietorships, which are relatively simple to establish, partnerships that allow for shared management and costs, and corporations, which offer limited liability protection. Each structure has its benefits and implications, making it essential for business owners to choose wisely based on their specific needs.

Once the business structure is decided, the first formal step is to register the proposed company name with the Djibouti Chamber of Commerce. This is crucial to ensure that the name is unique and complies with local naming regulations. Following name approval, the next step involves drafting the necessary documentation, which typically includes the statutes of the company, identification documents of the founders, and, if applicable, partnership agreements.

Subsequently, these documents must be submitted to the relevant government authority for registration. This process is usually handled by the Ministry of Commerce and Industry. Applicants should expect to provide additional documentation, which may include proof of a physical address, a description of the business activities, and details about the business’s directors or partners. It is important to note that there are registration fees, which vary depending on the form of business entity chosen. Therefore, prospective business owners should prepare for these costs as part of their initial setup expenditure.

After registration, businesses must also obtain a tax identification number from the tax administration, which is necessary for legal operations within Djibouti. Understanding the requirements of business permits and licenses applicable to specific sectors is crucial, as this can vary based on the nature of the business. Thorough preparation and adherence to these procedural steps will facilitate a smoother journey in establishing a business in Djibouti.

Legal Requirements for Starting a Business

Starting a business in Djibouti requires adherence to a series of legal obligations that are crucial for ensuring both compliance and sustainability. The first essential step is the acquisition of the necessary permits and licenses. Depending on the nature of the business, entrepreneurs may need specific licenses at the national, regional, or local levels. For instance, businesses involved in sectors such as construction, hospitality, and telecommunications often face stricter regulatory scrutiny and, as such, must meet additional requirements. Engaging with the Djibouti Chamber of Commerce can provide valuable insights into the specific licenses required for various types of business activities.

Additionally, it is imperative to understand the tax obligations imposed by the Djiboutian government. Businesses are required to register for tax identification numbers, file periodic tax returns, and comply with VAT regulations. Understanding the corporate tax rates and any potential tax incentives available for new businesses is critical for financial planning. Non-compliance with these fiscal responsibilities can result in severe penalties and enforcement actions, such as fines or business closures.

In terms of labor laws, it is vital for business owners to familiarize themselves with the local labor regulations. Djibouti has specific laws governing employment contracts, working hours, minimum wage, and employee rights. Abiding by these labor standards not only helps in cultivating a positive work environment but also mitigates the risk of disputes and legal action. Moreover, adherence to local labor laws enhances the reputation of a business, attracting potential employees and clients alike.

Failing to comply with these legal requirements may lead to significant repercussions. Conversely, fulfilling the necessary legal obligations can provide access to various business opportunities, including public contracts and partnerships. Understanding and implementing these legal frameworks not only fortifies the foundation of a new business but also empowers it to thrive in Djibouti’s evolving market landscape.

Navigating Taxation in Djibouti

Understanding the tax framework is critical for any business endeavor in Djibouti. The taxation system in Djibouti primarily consists of corporate taxes, Value Added Tax (VAT), and several other relevant taxes that businesses must comply with. The standard corporate tax rate in Djibouti is set at 25%, which is applicable to the net profits of corporations operating within the country. However, there are varying rates that may apply depending on specific business sectors, such as telecommunications and oil, where higher rates are imposed. It is essential for entrepreneurs to familiarize themselves with these nuances to accurately forecast their tax liabilities.

Value Added Tax (VAT) is another significant component of Djibouti’s tax structure. The standard VAT rate is 10%, applied to most goods and services, although some items may fall under different tax categories, including exemptions. This tax is levied at each stage of the supply chain, which requires careful accounting and compliance to ensure that businesses do not incur penalties. Entrepreneurs should be prepared to understand their responsibilities concerning VAT collection and remittance to the government.

In addition to these principal taxes, businesses in Djibouti may encounter various other taxes, such as registration fees, business license taxes, and property taxes. To facilitate business growth, the Djiboutian government offers several tax incentives aimed at attracting foreign investment, including exemptions and deductions for new businesses. Navigating the tax registration process involves several steps, including acquiring a tax identification number and ensuring compliance with local regulations. These measures are essential for undertaking successful business operations within the country.

In summary, comprehending the tax obligations and incentives available to businesses in Djibouti is an indispensable part of establishing a successful operation. A thorough understanding of corporate tax rates, VAT, and the registration process can significantly impact the financial health and sustainability of new ventures.

Key Growth Sectors for Businesses in Djibouti

Djibouti, strategically located at the crossroads of international shipping routes, offers a diverse range of opportunities for entrepreneurs. Among the most promising sectors for business investment are oil and technology. The oil sector is a key focus due to Djibouti’s emerging status as a potential energy hub in the region. This sector is characterized by considerable opportunities linked to oil exploration, refining, and distribution. Entrepreneurs looking to enter this space should closely monitor the evolving geopolitical landscape and regulatory environment, which can impact operations and investments.

The oil industry in Djibouti is particularly appealing due to its proximity to major markets, making it an advantageous location for companies looking to establish supply chains. However, prospective investors should be prepared to navigate various challenges such as infrastructure development, regulatory compliance, and competition from other regional players. Building partnerships with local stakeholders can also enhance competitiveness and facilitate smoother market entry.

On the flip side, the technology sector is rapidly gaining momentum, driven by increasing digitalization and innovation within the country. Djibouti’s government is actively promoting initiatives to foster a digital economy, making it an attractive landscape for tech startups and investment. Key areas of focus include telecommunication, e-commerce, and fintech. The growing smartphone penetration and internet accessibility create a fertile ground for tech-oriented businesses aimed at enhancing service delivery and improving operational efficiencies.

However, entering the technology sector does not come without its challenges. Entrepreneurs should be aware of the need for skilled labor, adequate infrastructure, and robust cybersecurity measures to protect digital assets. Overall, both oil and technology sectors present exciting prospects for business investment in Djibouti, but thorough market research and strategic planning are essential for navigating the complexities inherent in each industry.

Employment Laws and Work Permits

Employment laws in Djibouti are designed to protect workers’ rights and ensure fair treatment in the workplace. The Labor Code stipulates fundamental rights for employees, including the right to fair wages, safe working conditions, and a legal framework for employment contracts. Employers are required to provide written employment contracts detailing the terms of employment, which should encompass job responsibilities, working hours, and remuneration. These contracts play a critical role in safeguarding both the employer’s and employee’s rights, thus preventing disputes over employment terms.

Moreover, Djibouti’s labor legislation imposes restrictions on termination of contracts to ensure that employees are not unfairly dismissed. Employers must provide just cause for termination, and these justifications are outlined in the employment contract as well as within the labor laws. Employees are entitled to adequate notice before termination, typically ranging from one to three months, depending on the length of service, allowing time for said employees to seek other opportunities. This legal framework aims to foster a stable work environment and minimize abrupt job loss concerns for employees.

For employers looking to hire foreign workers, obtaining a work permit is a critical step in compliance with Djibouti’s employment laws. The process requires employers to apply for a work permit through the Ministry of Labor, providing necessary documentation that includes the employment contract, proof of the company’s legal status, and a vacancy advertisement that demonstrates an unmet local labor demand. Additionally, employers must adhere to specific legal stipulations, such as ensuring that the foreign employee possesses the relevant skills that are not readily available in the local labor market. By understanding and navigating these regulations, businesses can attract talent while maintaining compliance with Djibouti’s legal requirements for employment and immigration. This preparation ultimately supports a thriving workforce conducive to economic growth.

Funding and Financial Support for Businesses

Starting a business in Djibouti requires understanding the various funding avenues available to entrepreneurs. The financial landscape in Djibouti is evolving, with diverse options ranging from local banks to international financial institutions. Local banks are often the first point of contact for entrepreneurs seeking financial support. These banks typically offer various loan products tailored to small and medium-sized enterprises (SMEs). Familiarizing oneself with the specific requirements and conditions of local banks can significantly improve an entrepreneur’s chances of securing funding.

In addition to local banks, international financial institutions play a crucial role in providing funding and financial support. Organizations such as the African Development Bank and the World Bank offer various financing solutions aimed at fostering economic development in African countries, including Djibouti. Entrepreneurs should explore these resources as they may provide larger amounts of capital and more favorable terms compared to local financing options.

Furthermore, grants from governmental entities or non-governmental organizations can also provide financial assistance to startups. These grants often do not require repayment, making them particularly appealing for new entrepreneurs. However, applying for grants can involve a competitive process, requiring a well-drafted business proposal that outlines the business objectives and potential impact on the community.

Another vital source of funding is venture capital. Djibouti’s budding entrepreneurial ecosystem has begun attracting investors looking for promising startups. Entrepreneurs should focus on developing a robust business plan that clearly delineates their unique value proposition, market analysis, and financial projections. Crafting a strong business proposal is crucial not only for securing bank loans or grants but also for appealing to potential investors who seek assurance in their investment decisions.

Conclusion and Key Takeaways

Starting a business in Djibouti entails navigating a complex legal landscape that requires a comprehensive understanding of the local regulations and procedures. As highlighted throughout this guide, the benefits of establishing a business in this strategic location—such as access to international shipping routes and a growing economy—are accompanied by the necessity to adhere to various legal requirements. Entrepreneurs must be well-informed about the legal framework to ensure compliance and facilitate a smooth business launch.

One of the essential points discussed is the importance of choosing the appropriate legal structure for your business. Djibouti offers several options—including sole proprietorships, partnerships, and limited liability companies—each with distinct implications for taxation, liability, and management. Careful consideration of these options will not only impact the operational efficiency of the business but also its long-term viability.

Furthermore, obtaining the necessary licenses and permits is crucial in maintaining legal compliance and avoiding potential penalties. Aspiring entrepreneurs should initiate this process early and seek guidance on the specific requirements related to their industry. Additionally, navigating the tax obligations in Djibouti is vital, as this knowledge can influence financial planning and overall profitability.

In light of the intricacies involved in starting a business in Djibouti, it is advisable for entrepreneurs to engage with legal professionals experienced in local commercial law. Such guidance can ensure that potential pitfalls are avoided and that the business is established on a solid legal foundation. With the right support and resources, entrepreneurs can capitalize on the opportunities available in Djibouti and contribute to its economic growth. Ultimately, understanding the legal landscape is not just important, it is imperative for a successful business endeavor in Djibouti.