Federal Democratic Republic of Ethiopia | |

|---|---|

| Anthem: ወደፊት ገስግሺ ፣ ውድ እናት ኢትዮጵያ "Wedefīt Gesigishī Wid Inat ītiyop’iy" (English: "March Forward, Dear Mother Ethiopia") | |

| Capital and largest city | Addis Ababa 9°1′N 38°45′E / 9.017°N 38.750°E |

| Official languages | |

| Ethnic groups (2007) | |

| Religion (2016) |

|

| Demonym(s) | Ethiopian |

| Government | Federal parliamentary republic under an authoritarian government |

| Taye Atske Selassie | |

| Abiy Ahmed | |

| Temesgen Tiruneh | |

| Tewodros Mihret | |

| Legislature | Federal Parliamentary Assembly |

| House of Federation | |

| House of Peoples' Representatives | |

| Formation | |

| 980 BC | |

| 400 BC | |

| 1270 | |

| 7 May 1769 | |

| 11 February 1855 | |

| 1904 | |

| 9 May 1936 | |

| 31 January 1942 | |

| 12 September 1974 | |

| 22 February 1987 | |

| 28 May 1991 | |

| 21 August 1995 | |

| Area | |

Total | 1,104,300 km2 (426,400 sq mi) (26th) |

Water (%) | 0.7 |

| Population | |

2024 estimate | |

2007 census | |

Density | 92.7/km2 (240.1/sq mi) (123rd) |

| GDP (PPP) | 2024 estimate |

Total | |

Per capita | |

| GDP (nominal) | 2024 estimate |

Total | |

Per capita | |

| Gini (2015) | medium inequality |

| HDI (2022) | low (176th) |

| Currency | Birr (ETB) |

| Time zone | UTC+3 (EAT) |

| Date format | dd/mm/yyyy |

| Calling code | +251 |

| ISO 3166 code | ET |

| Internet TLD | .et |

Table of Contents

Introduction to Insurance in Ethiopia

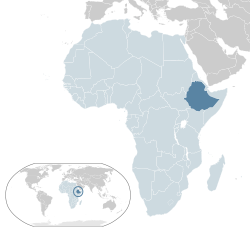

The insurance landscape in Ethiopia is evolving, playing a vital role in the nation’s economic development and risk management strategies. Insurance serves as a safeguard for individuals, families, and businesses against unforeseen events that may lead to financial losses. As Ethiopia continues to develop and integrate into the global economy, awareness and engagement with various insurance products have become increasingly relevant.

Understanding the significance of insurance goes beyond mere financial protection; it is essential for fostering stability and building resilience within the economy. By transferring risk from individuals and businesses to insurance providers, the likelihood of significant financial hardship following adverse events is minimized. This contributes to overall economic stability, encourages investment, and supports entrepreneurial activities.

Various socio-economic factors influence the adoption of insurance products among the Ethiopian population. These include cultural perceptions of risk, economic empowerment, and increasing levels of education. As the country advances, there is a growing recognition of the need for insurance as a critical component of personal and business financial planning. Furthermore, the government has taken steps to foster a regulatory environment conducive to the growth of the insurance sector, thereby attracting private and foreign investments.

This blog post aims to provide a comprehensive overview of the different types of insurance available in Ethiopia, including health, auto, property, and liability insurance. By detailing these insurance categories, we intend to equip readers with the necessary knowledge to make informed decisions about their insurance needs. The insights gained will underscore the importance of adopting suitable insurance products as a means of reinforcing financial security and promoting economic progress in Ethiopia.

Health Insurance in Ethiopia

Health insurance in Ethiopia has evolved significantly over the years, offering various options tailored to the needs of its citizens. The primary forms of health insurance include governmental schemes, private health insurance options, and community-based health interventions. Each type serves as a means to enhance access to healthcare services and mitigate the financial burdens associated with medical care.

The Ethiopian government has implemented several health insurance schemes aimed at covering a larger segment of the population. One of the notable initiatives is the Community-Based Health Insurance (CBHI), which caters to rural communities who typically have limited access to formal healthcare facilities. CBHI aims to provide affordable healthcare coverage, allowing members to receive treatment for illnesses at a fraction of the cost. This approach is pivotal in increasing healthcare accessibility and promoting well-being in underserved regions.

In addition to governmental initiatives, private health insurance has gained traction in urban areas. These plans often offer a broader range of services and quicker access to healthcare providers, albeit at a higher premium cost. Private health insurance can vary significantly in its coverage limits and terms, which can lead to discrepancies in what individuals receive in terms of care. Consumers are encouraged to thoroughly assess their options to find a plan that aligns with their healthcare needs and financial circumstances.

The Ethiopian government’s role in the promotion of health insurance is noteworthy. Recent reforms have been enacted to improve the regulatory framework for both public and private insurance providers, ensuring increased transparency and efficiency. These reforms also aim to enhance the affordability and quality of healthcare services across the country, fostering an environment where health insurance is not only a safety net but a fundamental aspect of the Ethiopian healthcare system.

Auto Insurance in Ethiopia

In Ethiopia, auto insurance is becoming increasingly important due to rising vehicle ownership and the need for financial protection against accidents and damages. Two primary categories of auto insurance products are present in the market: compulsory third-party insurance and optional comprehensive coverage. Compulsory third-party insurance is mandated by law, requiring all vehicle owners to obtain this coverage to ensure they are financially responsible for damages or injuries caused to third parties in the event of an accident. This not only protects the victims but also promotes accountability among drivers.

Comprehensive auto insurance, while not legally required, provides a more extensive safety net. This coverage typically includes protection against vehicle theft, fire damage, and other perils such as vandalism or natural disasters. Drivers may opt for comprehensive coverage based on their financial circumstances and personal preferences, especially if they own a relatively new or high-value vehicle. The costs associated with auto insurance in Ethiopia can vary significantly depending on factors such as the type of coverage chosen, the vehicle’s make and model, and the driver’s history.

Obtaining auto insurance in Ethiopia involves several steps, typically starting with a comparison of different providers and their offerings. It is advisable for individuals to seek quotes from multiple insurers to make informed decisions. After selecting an insurer, the individual must provide necessary documentation, including a copy of the vehicle registration and proof of identification. Once the policy is active, claim settlement procedures must be followed in the event of an accident or damage, which generally include notifying the insurance company promptly and providing any necessary evidence, such as police reports or photographs.

Furthermore, traffic regulations play a crucial role in shaping auto insurance practices in Ethiopia. Effective enforcement of traffic laws can lead to a reduction in accident rates, which, in turn, may influence insurance premiums. As awareness of the importance of auto insurance grows, it is paramount for vehicle owners in Ethiopia to remain informed about their coverage options and obligations.

Property Insurance in Ethiopia

Property insurance in Ethiopia plays a crucial role in mitigating financial loss due to unexpected events affecting both residential and commercial properties. This insurance type encompasses a broad range of policies designed to provide coverage for various risks, including natural disasters, fire, theft, and more. As urbanization continues to rise in Ethiopia, it becomes increasingly important for property owners to understand the specific policies available to them.

In general, property insurance can be categorized into two primary types: residential and commercial. Residential property insurance typically covers private homes and personal belongings against damages caused by covered perils. These perils may include but are not limited to fire, water damage, and theft. On the other hand, commercial property insurance protects businesses and their assets against similar risks, ensuring that they remain operational even after unforeseen incidents.

The claim process for property insurance in Ethiopia generally involves several steps. First, the policyholder must report the damage or loss to the insurance company promptly. Following this notification, an insurance adjuster may be dispatched to assess the extent of the damage. This assessment forms the basis for the claim settlement, where the insurer determines the value of the loss and the amount to be compensated. Additionally, understanding Ethiopian property laws is imperative, as these regulations can influence claim procedures and the obligations of both the insurer and the policyholder.

Property insurance is particularly relevant in both urban and rural contexts across Ethiopia. Urban areas often face risks associated with dense populations and infrastructure-related hazards, while rural properties may experience challenges tied to agricultural practices and natural calamities. Consequently, having a suitable property insurance policy can provide vital peace of mind to property owners, ensuring that they are financially protected against potential hazards.

Liability Insurance in Ethiopia

Liability insurance is an integral component of risk management for both businesses and individuals in Ethiopia. This type of insurance serves to protect insured parties from claims arising out of their actions, ensuring they are safeguarded against legal and financial repercussions. There are several forms of liability insurance available, including general liability, professional liability, and product liability insurance, each catering to specific needs and scenarios.

General liability insurance is a fundamental type of coverage that protects businesses against claims of bodily injury, property damage, and personal injury that may occur on their premises or as a result of their operations. This policy is vital for companies engaged in any form of business activity in Ethiopia, providing a safety net against lawsuits and exorbitant damages that can threaten financial stability.

Professional liability insurance, often referred to as errors and omissions insurance, is tailored for professionals such as doctors, lawyers, and consultants. This coverage protects against claims of negligence, misrepresentation, or failure to perform professional duties. In the context of Ethiopia, where the economy is growing and more professionals are establishing their practices, this type of liability insurance is crucial in averting potential legal challenges arising from professional services.

Product liability insurance, on the other hand, safeguards businesses against claims linked to injuries or damages caused by their products. This insurance is especially important for manufacturers and retailers in Ethiopia as it mitigates the financial risks associated with product recalls, defects, or malfunctions.

The legal framework guiding liability insurance in Ethiopia emphasizes the importance of compliance with local laws and regulations. Businesses operating in the country must understand their liabilities and the protective measures available to them. Consequently, engaging with qualified insurance providers can ensure adequate coverage and adherence to necessary legal standards, thereby enhancing business sustainability.

Legal Framework for Insurance in Ethiopia

The legal framework governing the insurance industry in Ethiopia is primarily established through several key pieces of legislation and regulatory bodies. The Insurance Business Proclamation of 2010 serves as the cornerstone of this framework, laying down crucial guidelines for the establishment and operation of insurance companies within the country. This proclamation guarantees the protection of policyholders’ rights while promoting high standards of conduct among insurance providers.

Cognizant of the need for maintaining stability in the insurance sector, the National Bank of Ethiopia functions as the regulatory authority overseeing the activities of insurers. This body is responsible for issuing licenses, supervising insurance operations, and enforcing compliance with established regulations. The National Bank of Ethiopia also plays a pivotal role in monitoring the financial health of insurance companies, ensuring they remain solvent to meet policyholder obligations.

In addition to national regulations, Ethiopian insurers must also align with various international standards that focus on promoting transparency and establishing best practices in risk management and financial reporting. The adoption of guidelines from organizations such as the International Association of Insurance Supervisors (IAIS) reflects Ethiopia’s commitment to integrating globally recognized practices into its local insurance regulatory framework.

Compliance with this comprehensive legal framework is essential for all stakeholders in the Ethiopian insurance sector, including insurers, reinsurers, brokers, and policyholders. For insurance providers, adherence to these regulations not only mitigates the risk of legal penalties but also fosters consumer trust in the industry. Policyholders benefit from increased transparency and accountability, which collectively contribute to a more sustainable insurance market in Ethiopia. As the country continues to develop economically, the importance of a robust legal framework for insurance cannot be overstated, as it stands as a pillar for the growth and integrity of the industry.

Challenges Facing the Insurance Sector in Ethiopia

The Ethiopian insurance sector is currently confronted with a myriad of challenges that hinder its growth and accessibility. One of the most significant issues is the limited public awareness regarding the importance and benefits of insurance. A considerable percentage of the population remains uninformed about how insurance works, which types of insurance are available, and the advantages of being insured. This lack of understanding significantly restricts the adoption of insurance products among individuals and businesses alike, thereby stunting market growth and increasing the risk exposure of the populace.

Another critical challenge is the under-development of the insurance market itself. Despite the existing policy frameworks, the market is relatively small and dominated by a few players, leading to a lack of competition. This results in limited product offerings and low innovation in terms of insurance solutions tailored for diverse customer needs. Additionally, the regulatory environment, while improving, can be slow to adapt to global standards, thus limiting the sector’s potential for growth and modernization. The dependence on traditional insurance lines further exacerbates these issues, leaving gaps in areas such as health insurance, which could cater to the broader population.

Moreover, the prevailing economic conditions also play a significant role in the challenges faced by the insurance sector. High inflation rates, currency depreciation, and periodic economic instability undermine consumer confidence, which in turn affects insurance uptake. In an environment where many are struggling financially, the notion of allocating resources towards insurance often seems non-essential. Addressing these challenges requires an integrated approach that includes enhancing public awareness, establishing more competitive market conditions, and creating a supportive economic environment. Initiatives such as educational campaigns and financial literacy programs could play a vital role in promoting the importance of insurance in safeguarding against unforeseen circumstances.

Recent Developments in Ethiopian Insurance

The Ethiopian insurance landscape has witnessed significant changes in recent years, driven by a combination of market demands and government initiatives. One of the most notable trends is the increasing digitization of insurance services. Many insurers are now leveraging technology to streamline operations, enhance customer experience, and improve service delivery. This shift towards digital platforms enables customers to access insurance products and manage their policies conveniently, helping to cater to a tech-savvy population.

In addition to digitization, innovative insurance products have emerged, tailored to meet the specific needs of the local market. As the economy develops and consumer needs evolve, insurance providers are responding with products that address various risks prevalent within Ethiopian society. For instance, there has been a marked increase in microinsurance products designed to provide affordable coverage for low-income individuals. Such innovations are not only expanding the market reach but also playing a crucial role in enhancing financial inclusion.

Moreover, the Ethiopian government is actively promoting insurance penetration through various initiatives. This includes regulatory reforms aimed at creating a more conducive environment for both existing players and new entrants in the insurance sector. Additionally, awareness campaigns are being conducted to educate the public on the importance of insurance. This effort is intended to foster a culture of risk management, which is essential for the overall economic stability and growth of the country.

These recent developments indicate a promising trajectory for the Ethiopian insurance market. The ongoing digital transformation, coupled with the introduction of products that resonate with local needs, suggests that the sector will continue to grow. Future investment and policy adjustments, alongside consumer education, will likely further bolster the insurance landscape, driving increased participation and sustainability in the market.

Conclusion

In conclusion, understanding the various types of insurance available in Ethiopia—namely health, auto, property, and liability insurance—is crucial for individuals and businesses alike. Each type serves a specific purpose in mitigating risks and securing financial stability. Health insurance, for instance, is essential for ensuring that individuals can access necessary medical care without incurring exorbitant costs. The rising need for comprehensive health coverage in the population underscores its significance in improving public health outcomes.

Auto insurance is equally important, providing protection against financial losses from vehicle accidents, theft, and liabilities. With an increase in vehicle ownership in Ethiopia, securing auto insurance forms a vital part of responsible vehicle management. Furthermore, property insurance safeguards one’s assets against unforeseen events such as fire, natural disasters, or theft. It not only protects the investments made in real estate or personal belongings but also contributes to peace of mind for property owners.

Liability insurance holds its place as a protective measure against claims resulting from injuries or damage to third parties. This type of insurance is especially relevant for businesses, as it shields them from potential lawsuits and financial repercussions. The significance of liability coverage has grown, particularly in a developing market like Ethiopia, where businesses are navigating a variety of operational challenges.

The Ethiopian insurance market presents substantial growth potential. As awareness of the importance of insurance continues to spread, alongside economic development, increased participation in various insurance products is likely. Readers are encouraged to explore the diverse insurance options available to them, evaluate their specific needs, and consider the long-term benefits of obtaining adequate coverage. Making informed decisions about insurance not only secures individual financial futures but also bolsters the overall stability of the economy.