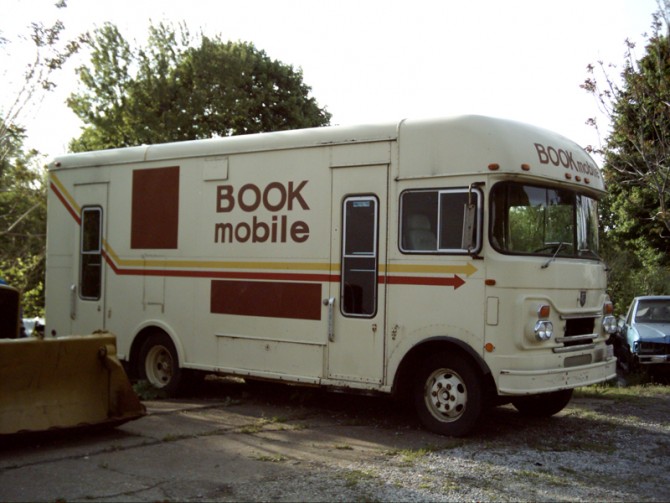

Bookmobiles provide the public with a one-of-a-kind way to access reading resources. Since the first bookmobile was started by librarian Mary Titcomb at the beginning of the twentieth century, these tiny companies have met the public’s reading requirements in both rural and urban regions. Bookmobiles provide amusement and education to individuals who may not otherwise have access to books, whether as a for-profit company selling books to consumers or as a public service provided by certain libraries.

While the popularity of bookmobiles has risen and fallen over the last century, these mobile bookshops and libraries continue to be ideally fitted to satisfy the demands of the contemporary reader. The number of bookmobiles has increased throughout the country since the early 2000s. With more people — both adults and children — remaining at home for employment and education, this trend is expected to intensify. Bookmobiles may serve their communities’ reading needs by reaching citizens wherever they are.

Table of Contents

Follow these ten steps to start a bookmobile business:

Plan your Bookmobile Enterprise

Make your Bookmobile Company a Legal Entity.

Register your Bookmobile Company for Taxes.

Create a Business Bank Account and a Credit Card

Set up Accounting for your Bookmobile Company

Get the Permits and Licenses You Need for Your Bookmobile Business

Purchase Bookmobile Business Insurance.

Create a Bookmobile Business Brand

Make a website for your Bookmobile Business.

Configure your Business Phone System

Starting a company entails more than just registering it with the state. This straightforward guide to launching your bookmobile company has been put together by us. These stages will guarantee that your new company is well-planned, correctly registered, and legally compliant.

STEP 1: Make a business plan.

A well-thought-out strategy is vital for entrepreneur success. It will assist you in mapping out the intricacies of your organisation and uncovering some unknowns. Consider the following crucial topics:

What are the initial and continuing expenses?

Who is your intended audience?

How much money may you charge your customers?

Fortunately, we have done a lot of the legwork for you.

What are the expenses of starting a bookmobile business?

The price of beginning a bookmobile company might vary greatly based on your needs. Purchasing a new car, outfitting it for business with racks, etc., and stocking it with fresh books may cost more than $100,000. On the low end, you could buy a used automobile for less than $5,000, perform your own improvements, and start with a stock of secondhand books. In this situation, you may be able to get started for $10,000 or less.

What are the continuing costs of running a bookmobile business?

According to the Association of Bookmobile and Outreach Services, the average yearly cost of operating a bookmobile is roughly $200,000 per year (ABOS). It is evident that you must constantly refill your book inventory, but you must also plan for other recurring costs such as car maintenance. You’ll most likely have to drive your bookmobile every day, which will cause wear and tear. You should budget for repairs as part of your business plan for any work car.

Who is the intended audience?

A bookmobile service might cater to a variety of market niches. Potential target audiences include literature fans, students, youngsters, the elderly, and anyone who do not have access to a local library or bookshop.

How does a bookmobile company earn money?

Bookmobile enterprises generate revenue by selling books and associated things to the general public. Some bookmobiles, such as those sponsored by libraries, may be run as NGOs. Nonprofit bookmobiles are often funded by the government.

How much money may you charge your customers?

A bookmobile company distributes identical items to bookshops at comparable pricing. A normal paperback book may cost between $9.99 and $19.99, and hardcover novels can cost up to $27.99.

How much money can a bookmobile company make?

Independent bookselling is not normally a profitable business. The majority of independent bookstores have profit margins of 2% to 3%. If you can reduce your bookmobile’s running expenses, you may be able to save money over hiring a physical place for your company. However, you can still expect to operate on razor-thin profit margins.

How can you increase the profitability of your company?

There are various strategies to increase the profitability of your firm. First, look for goods to offer in addition to books since they frequently have a higher profit margin. Bookmarks, notebooks, and themed mementos may help you increase your earnings. If your market demand allows it, running more than one bookmobile is another option to increase your profits. When you have numerous bookmobiles and can service a larger region, you may boost income while gaining economies of scale.

STEP 2: Establish a legal entity

Sole proprietorship, partnership, limited liability company (LLC), and corporation are the most frequent business structure forms.

If your bookmobile company is sued, forming a legitimate business entity, such as an LLC or corporation, safeguards you from being held personally accountable.

STEP 3: File your taxes

Before you can begin for business, you must register for a number of state and federal taxes.

To register for taxes, you will need to get an EIN. It’s really simple and completely free!

Taxes on Small Businesses

Depending on the business form you choose, you may have multiple choices for how your company is taxed. Some LLCs, for example, may benefit from being taxed as a S company (S corp).

These guides will teach you more about small company taxes:

Taxes on LLCs

LLC vs. sole proprietorship

Corporation vs. LLC

S Corp vs. LLC

How to Form a S Corporation

S Corporation vs. C Corporation

There may be state taxes that apply to your company. In our state sales tax guides, you may learn more about state sales taxes and franchise taxes.

STEP 4: Establish a company bank account and credit card

Personal asset protection requires the use of distinct business banking and credit accounts.

When you combine your personal and business accounts, your personal assets (your house, vehicle, and other possessions) are at danger if your company is sued. This is known as penetrating your company veil in business law.

Furthermore, understanding how to develop corporate credit may help you get credit cards and other financing in your company’s name (rather than your own), lower interest rates, larger lines of credit, and other benefits.

Establish a business bank account.

Opening a business bank account is not only required when asking for business financing, but it also:

Separates your personal assets from the assets of your firm, which is required for personal asset protection.

It simplifies bookkeeping and tax reporting.

Create a net 30 account.

Net 30 accounts are used to develop and grow company credit while also increasing cash flow. Businesses use a net 30 account to purchase items and refund the whole debt within a 30-day period.

Many net 30 credit suppliers submit information to the main business credit agencies (Dun & Bradstreet, Experian Business, and Equifax Business Credit). This is how firms establish business credit in order to get approved for credit cards and other lines of credit.

Apply for a business credit card.

Obtaining a business credit card benefits you in the following ways:

Put all of your company’s costs in one location to separate personal and business spending.

Build your company’s credit history, which will be important for raising funds in the future.

STEP 5: Establish business accounting

Recording your numerous costs and sources of revenue is crucial to assessing your company’s financial status. Keeping precise and thorough accounting also makes yearly tax filing much easier.

STEP 6: Obtain all required permissions and licences

Failure to get appropriate permissions and licences may result in significant penalties or possibly the closure of your firm.

Requirements for State and Local Business Licensing

To run an affiliate marketing firm, some state licences and licences may be required. Visit the SBA’s reference to state licences and permits to learn more about licencing requirements in your state.

For information on local licences and permissions, visit:

Check with the clerk’s office in your town, city, or county.

Contact one of the local organisations mentioned in the US Small Business Associations database of local business resources for help.

STEP 7: Obtain commercial insurance.

Insurance, like licences and permits, is required for your company to operate safely and legally. In the case of a covered loss, business insurance protects your company’s financial well-being.

There are several sorts of insurance plans designed for various types of companies with varying risks. If you are unaware about the hazards that your company may encounter, start with General Liability Insurance. This is the most popular coverage required by small companies, so it’s a good place to start for yours.

Workers’ Compensation Insurance is another important insurance product that many companies need. If your company will have workers, your state may require you to purchase Workers’ Compensation insurance.

STEP 8: Establish your brand

Your company’s brand is what it stands for, as well as how the public perceives it. A strong brand will help your company stand out from the crowd.

How to Promote and Market a Bookmobile Company

If you do community outreach before starting your company, you will have some public awareness on which to leverage. However, you must do much more to sell your company. Begin by making your bookmobile stand out. Create a creative logo and paint your car so that people understand the nature of your company right away. Next, try your hand at social media marketing. Regular social media updates informing people about your forthcoming locations and products will help you attract more customers.

How to Keep Customers Returning

Customers will return to your bookmobile if you provide personalised service. Customers will come again and again if you can assist them locate books they like. It’s also critical to keep clients up to date on your location and offers. Because your company is mobile, you must let people know where they can find you.

STEP 9: Create your company’s website.

After you’ve defined your brand and designed your logo, the next step is to build a website for your company.

While developing a website is an important step, some may be concerned that it is out of their grasp due to a lack of website-building skills. While this was a fair concern in 2015, online technology has made significant advances in recent years, making the lives of small company owners considerably easier.

The following are the primary reasons why you should not put off developing your website:

Every genuine company has a website, period. When it comes to bringing your company online, it doesn’t matter what size or sector it is.

Social media accounts, such as Facebook pages or LinkedIn company profiles, are not a substitute for your own business website.

STEP 10: Install your company phone system.

Getting a phone for your company is one of the finest methods to keep your personal and professional lives distinct and private. That isn’t the only advantage; it also helps you automate your company, provides it legitimacy, and makes it simpler for prospective clients to identify and contact you.