In finance, a junk bond (non-investment-grade bond, speculative-grade bond, or junk bond) may be a bond that’s rated below investment grade. These bonds have a better risk of default or other adverse credit events, but offer higher yields than better quality bonds so as to form them attractive to investors.

Like many sectors of the worldwide fixed income markets, high yield bonds have generated strong returns for investors in recent years.1 Yields have declined to close all-time lows2 and defaults have remained, in our opinion, at very manageable levels. In light of recent performance, many investors have asked us whether high yield bonds can still generate attractive returns and whether or not they should maintain an allocation to them within their fixed income portfolios.

We feel that prime yield bonds remain one among the foremost appealing investment options available in fixed income, which an actively managed portfolio of high yield bonds are often a wise a part of a client’s overall portfolio. We expect default rates to still remain low and high yield issuers are likely to be supported by ongoing moderate economic process , underlining their ability to service debt.

In particular, we believe that a high yield portfolio focused on middle market issuers can potentially offer investors a beautiful means of accessing high yields thanks to certain characteristics of those borrowers. This belief is predicated on our proprietary research that demonstrates middle market high yield bonds offers a big yield advantage relative to the broader high yield market, have less sensitivity to interest rates, and demonstrate lower volatility than larger issuers.

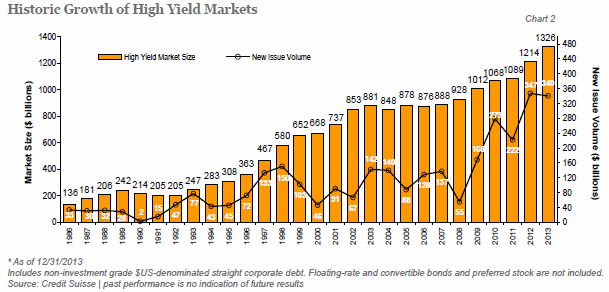

The high yield market is overflow one trillion dollars in size and consists of corporate bonds rated BB+ and below by the main credit rating agencies.3 reciprocally for his or her increased credit risk, high yield bonds typically offer higher yields than U.S. Treasury bonds and investment grade corporate bonds. As evident by

its size, the high yield market may be a mature sector of the fixed income markets and has developed significantly since its start within the 1980s.

Table of Contents

Non-investment grade vs investment grade

Non-investment grade ratings are those less than BBB- (or its equivalent), while an investment grade rating (or corporate rating) is BBB- or higher.

A non-investment grade rating is vital because it suggests a greater chance of an issuer’s default, wherein the corporate doesn’t pay the coupon/interest due on a bond or the principal amount due at maturity during a timely manner.

Consequently, non-investment grade debt issuers must pay a better rate of interest – and in some cases they need to make investor-friendly structural features to the bond agreement – to catch up on bondholder risk, and to draw in the interest of institutional investors.

Background – Public v private

Some background is so as . The overwhelming majority of loans are unambiguously private financing arrangements between issuers and lenders. Even for issuers with public equity or debt, and which file with the SEC, the credit agreement becomes public only it’s filed – months after closing, usually – as an exhibit to an annual report (10-K), a quarterly report (10-Q), a current report (8-K), or another document (proxy statement, securities registration, etc.).

Beyond the credit agreement there’s a raft of ongoing correspondence between issuers and lenders that’s made under confidentiality agreements, including quarterly or monthly financial disclosures, covenant compliance information, amendment and waiver requests, and financial projections, also as plans for acquisitions or dispositions. Much of this information could also be material to the financial health of the issuer, and should be out of the general public domain until the issuer formally issues a handout , or files an 8-K or another document with the SEC.

What is a junk bond?

“Junk bond,” or “speculative-grade bond” simply are other names for a high yield bond. These terms helped give the asset class some negative connotation in its more youth . The asset class has matured into an outsized , liquid marketplace, however, which now attracts a broad swath of investors and multitudes of issuers.

How big is that the high yield bond market?

After growing rapidly over the past 10-15 years, high yield now comprises roughly 15% of the general corporate (investment grade) bond market, which itself is estimated at roughly $8.1 trillion, trailing the U.S. Treasury market ($12.7 trillion outstanding) but larger than the bond market ($3.7 trillion outstanding), consistent with second-quarter 2015 estimates by industry trade group market and Financial Markets Association (SIFMA).

Market history

Corporate bonds are around for hundreds of years , but growth of the non-investment-grade market didn’t begin until the 1970s. At this point , the market was composed primarily of companies that had been downgraded for various reasons from investment-grade, becoming “fallen angels,” (you can examine those here) and which continued to issue debt securities.

The first real boom within the market was within the 1980s, however, when leveraged buyouts and other mergers appropriated high-yield bonds as a financing mechanism. Probably the foremost famous example is that the $31 billion LBO of RJR Nabisco by private equity sponsor Kohlberg Kravis & Roberts in 1989 (the financing was detailed within the best-selling book Barbarians at the Gate).

The financing backing the deal included five high-yield issues that raised $4 billion. While certainly there are huge deals in market since that transaction, it’s still notable today because the 16th largest high-yield offering on record, consistent with LCD.

Since then, more companies have found acceptance with a growing pool of investors because the high-yield market developed. High-yield bonds still are wont to finance merger and acquisition activity, including LBOs (you’ll note that the majority of the deals within the table above backing leveraged buyouts), and sometimes back dividend payouts to non-public equity sponsors, and therefore the market still supports funding capital-intensive projects, like telecommunications build-out, casino development and energy exploration projects.

These days, though, the market is also an honest deal of its own refinancing mechanism, with proceeds often paying off older bonds, bank loans and other debt.

The high-yield market matured through increasing new bond issuance, which reached a peak of $287 billion in 2010, and via additional fallen angels, most notably Ford Motor Company and General Motors in 2005. Indeed, with the automakers’ combined $80 billion of fallen angel corporate bonds downgraded into the asset class, high-yield ballooned to roughly $1 trillion in 2006. Just ten years earlier, the asset class was a humble $200 billion, consistent with SIFMA. And with the continued new issuance weighed against maturing bonds and other bond take-outs, the market has held around approximately $1 trillion, consistent with Bank of America Merrill Lynch.

Steady growth of the junk bond market saw only a couple of notable speed bumps. There was the savings & loan scandal within the 1980s, the correction after the “tech wreck” in 2001, and in fact last the subprime mortgage meltdown, liquidity crisis and financial crisis of 2008. Issuance that year was just $69 billion, rock bottom in seven years, consistent with LCD.

High yield bond issuers

Companies issuing high yield bonds usually are seeking money for growth (via M&A, perhaps), for capital and for other cash-flow purposes, or to refinance existing loans, bonds, or other debt.

Companies with outstanding high-yield debt cover the spectrum of industry sectors and categories. There are industrial manufacturers, media firms, energy explorers, homebuilders and even finance companies, to call a couple of . The one thing in common – indeed the sole thing – may be a high debt load, relative to earnings and income (and, thus, the non-investment grade ratings). It’s how the issuers got there that breaks the high-yield universe into categories.

The most frequent sorts of issuers are detailed below. As well, other capital-intensive businesses, like oil prospecting, find investors within the junk bond market, as do cyclical businesses, like chemical producers.

Fallen angels

The first high-yield companies were the “fallen angels,” or entities that wont to carry higher ratings, before falling on adversity . These companies might find liquidity within the high-yield market and improve their balance sheets over time, for an eventual upgrade. Some fallen angels often hover round the high-grade/high-yield border, and regularly carry investment grade ratings by one agency and non-investment grade by another. These often are mentioned as “crossover,” “split-rated,” or “five-B” bonds. Other issuers might never improve, and head further down the size , toward deep distressed and potentially default and/or file for bankruptcy.

There were 26 fallen angels globally in 2016’s half (through June 8). Leading the pack: Financial institutions, mining/commodities companies, and oil & gas concerns. Of the 26 fallen angels, half are from the U.S.

Start-ups

Frequently, high-yieldissuers are start-up companies that require seed capital. they are doing not have an operational history or record strong enough to realize investment grade ratings. Investors weigh heavily on the business plan and pro forma financial prospects to guage prospects with these scenarios. Telecommunications network builds and casino construction projects are examples.

Bankruptcy exit

Bankruptcy exit financing are often found within the high-yield market. Publisher of the National Enquirer American Media and auto-parts company Visteon are recent examples. Both were well received in market during the primary half 2011 and secured the exit financing despite past investor losses with the credits.

LBOs

Leveraged buyouts (LBOs) typically use high-yield bonds as a financing mechanism, and sometimes the private investors will use additional bond placements to fund special dividend payouts. This a part of the market saw explosive growth in 2005-06, amid a buyout boom not seen since the late 1980s, but within the 2005-2007 bubble, only to fizzle within the ensuing crisis. Indeed, LBO-related high-yield issuance peaked at $51 million 2007 only to slump to zero in 2009. It returned in 2010, though never to the pre-Lehman heights.

High yield bond investors

Investors in high-yield bonds primarily are asset-management institutions seeking to earn higher rates of return than their investment-grade corporate, government and cash-market counterparts. Other investors in high-yield include hedge funds, individuals and arrangers of instruments that pool debt securities.

Copy and paste this <iframe> into your site. It renders a lightweight card.

Preview loads from ?cta_embed=1 on this post.