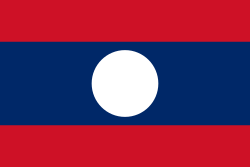

Lao People's Democratic Republic

| |

|---|---|

| Motto: ສັນຕິພາບ ເອກະລາດ ປະຊາທິປະໄຕ ເອກະພາບ ວັດທະນະຖາວອນ Santiphap, Ekalat, Paxathipatai, Ekaphap, Vatthanathavon "Peace, Independence, Democracy, Unity and Prosperity" | |

| Anthem: ເພງຊາດລາວ Pheng Xat Lao "Hymn of the Lao People" | |

| Capital and largest city | Vientiane 17°58′N 102°36′E / 17.967°N 102.600°E |

| Official languages | Lao |

| Spoken languages | |

| Ethnic groups (2015) | |

| Religion |

|

| Demonym(s) | |

| Government | One-party socialist state |

| Thongloun Sisoulith | |

| Bounthong Chitmany Pany Yathotou | |

| Sonexay Siphandone | |

| Saysomphone Phomvihane | |

| Legislature | National Assembly |

| Formation | |

| 1353–1707 | |

| 1707–1778 | |

Vassals of Siam | 1778–1893 |

| 1893–1953 | |

| 1945–1949 | |

| 11 May 1947 | |

| 22 October 1953 | |

Monarchy abolished | 2 December 1975 |

| Area | |

Total | 236,800 km2 (91,400 sq mi) (82nd) |

Water (%) | 2 |

| Population | |

2024 estimate | 7,953,556 (103rd) |

Density | 26.7/km2 (69.2/sq mi) |

| GDP (PPP) | 2024 estimate |

Total | |

Per capita | |

| GDP (nominal) | 2024 estimate |

Total | |

Per capita | |

| Gini (2012) | 36.4 medium inequality |

| HDI (2022) | medium (139th) |

| Currency | Kip (₭) (LAK) |

| Time zone | UTC+7 (ICT) |

| Calling code | +856 |

| ISO 3166 code | LA |

| Internet TLD | .la |

Table of Contents

Introduction to Company Formation in Laos

Understanding the intricacies of company formation in Laos is crucial for entrepreneurs and investors looking to tap into the opportunities presented by this burgeoning economy. As one of the fastest-growing markets in Southeast Asia, Laos has garnered attention for its attractive investment landscape, driven largely by its strategic location, rich natural resources, and a government keen on promoting foreign investment. With a focus on sustainable development, the Laotian government is actively working to simplify the business registration process and enhance the regulatory framework, making it easier for both local and foreign entities to navigate the market.

Starting a business in Laos offers several advantages, including low labor costs, a young workforce, and a favorable investment climate. These elements contribute to a competitive operational environment that appeals to various sectors such as agriculture, tourism, and manufacturing. Moreover, Laos benefits from several trade agreements with its neighboring countries, providing businesses with preferential access to larger markets. A thorough understanding of the company formation process will enable prospective business owners to leverage these benefits effectively.

In addition to economic incentives, potential investors must also grasp the regulatory environment that governs company formation in Laos. The country features various business structures, including sole proprietorships, limited liability companies, and joint ventures, each with its specific requirements and implications for liability and taxation. Foreign investors frequently opt for joint ventures to meet legal stipulations while facilitating their entry into the Laos market. By familiarizing themselves with the types of business structures available in Laos, entrepreneurs can make informed decisions that align with their objectives and risk profile.

Initial Registration Requirements

Beginning the journey of company formation in Laos necessitates a clear understanding of the initial registration requirements. One of the primary steps in this process is determining the appropriate business structure, which significantly impacts both the registration process and the operation of the business. In Laos, entrepreneurs can choose from several forms of business entities, including sole proprietorships, partnerships, and limited liability companies, each with its own legal implications and requirements.

Furthermore, it is crucial to recognize whether the proposed business involves local or foreign investment. Foreign investors often encounter specific regulations and limitations under Laotian law, particularly concerning ownership percentage and the types of businesses permitted for foreign participation. For instance, certain sectors may only allow limited foreign ownership, while others could demand that the majority interest be held by local investors. Understanding these nuances is imperative for adequate planning and compliance.

In addition to determining the business structure and investment type, potential business owners must be aware of specific thresholds that dictate registration procedures. Depending on the chosen entity type, different minimum capital requirements may apply. Limited liability companies, for instance, generally require a higher minimum capital compared to sole proprietorships. Investors should familiarize themselves with these thresholds to avoid any unnecessary complications during the registration process.

It is highly advisable to seek professional advice early in the company formation process in Laos. Experienced consultants can provide invaluable insights into the regulations and administrative procedures, ultimately facilitating smoother registration. Engaging with local legal and business experts can also help ensure compliance with the ever-evolving laws and standards in Laos, which are designed to support sustainable business practices.

Documentation Necessary for Company Registration

When establishing a company in Laos, a variety of documentation is required to ensure compliance with local laws and regulations. Both local and foreign investors must prepare essential documents that demonstrate their eligibility and readiness to operate within the country. The primary documentation required typically includes identification, financial proof, business plans, and potential sector-specific permits.

For local investors, a copy of the owner’s national identification card or family book is mandatory. Foreign investors, on the other hand, must submit a valid passport along with a notarized copy to verify their identity. This step is crucial, as it allows the relevant authorities to confirm the applicant’s legal status and evaluate their background.

Demonstrating financial capabilities is another vital aspect of the documentation process. Investors are generally required to provide bank statements or financial records showing sufficient funds to cover initial operating costs. This not only reflects the applicant’s financial stability but also reassures local authorities of their investment commitment.

A detailed business plan is also necessary, outlining the company’s goals, operational strategies, and projected financial forecasts. This document helps gauge the viability of the proposed business and is often a critical element in the approval process. Furthermore, depending on the industry, additional permits or sector-specific licenses may be necessary, particularly in regulated sectors such as manufacturing, health care, or hospitality.

Investors must ensure that all documentation is prepared accurately and submitted in the required formats. Failure to provide the necessary paperwork can lead to delays or rejections during the registration process. Thus, having a comprehensive understanding of the documentation necessary for company registration is essential for a successful business commencement in Laos.

Navigating Regulatory Filings

Establishing a business in Laos necessitates compliance with several regulatory filings that are critical to the company formation process. Initially, it is essential to register the company with the Ministry of Industry and Commerce (MoIC). This step involves the completion of specific application forms, which include details regarding the business name, type of business activity, and shareholder information. The MoIC provides specific guidelines on the necessary documents, which typically include identity proofs of directors and shareholders, a company charter, and evidence of a local address.

Once the preliminary registration is completed, entrepreneurs must apply for a business registration certificate. This involves submitting an application form along with the required documents to the MoIC. The application typically incurs a fee, which varies depending on the type and size of the business. After this, companies are mandated to obtain a Tax Identification Number (TIN) from the Ministry of Finance, which is essential for tax compliance and business operations. The TIN application also requires specific documentation, including the business registration certificate.

In addition to these primary registrations, various licenses may be required based on the industry sector of the business. For instance, businesses in sectors like food and beverage, pharmaceuticals, or education may require additional permits. These licenses ensure compliance with sector-specific regulations and may involve further filings with the relevant ministries or regulatory bodies.

Furthermore, timely submissions are crucial, as delays can result in penalties. Entrepreneurs are encouraged to consult with local legal or business professionals to navigate these regulatory filings efficiently. Ensuring compliance with all regulations not only facilitates a smoother business launch but also establishes a solid foundation for ongoing operations within the Lao market.

Understanding the Role of Business Licenses

In the realm of business formation in Laos, acquiring the appropriate business licenses holds substantial significance. The legal framework governing business operations mandates that specific licenses are obtained prior to commencing any commercial activities. Depending on the nature of the business and its respective industry, various licenses may be required. For example, companies involved in sectors such as manufacturing, tourism, or services face distinct licensing criteria tailored to their operational needs.

The application process for obtaining these licenses involves several steps. Initially, businesses must familiarize themselves with the specific licensing requirements applicable to their industry. This typically entails submitting a detailed business plan, alongside supporting documents that outline the operational framework of the prospective company. Once the application is submitted, relevant government bodies conduct evaluations to assess compliance with regulations. Approval times can vary widely, ranging from a few weeks to several months, influenced by the complexity of the application and the efficiency of the local regulatory authority.

Another critical aspect to consider is the duration for which these business licenses remain valid. Most licenses are issued for a specific period, necessitating timely renewals to ensure uninterrupted business operations. Failure to renew licenses can result in penalties or even the cessation of business activities, thereby underscoring the importance of maintaining compliance with regulatory obligations.

In recent years, the regulatory landscape in Laos has undergone changes aimed at improving the ease of doing business. These adjustments include the simplification of the licensing process and the introduction of online platforms for application submissions. Such reforms reflect the commitment of the Laotian government to support and foster a conducive environment for business operations, making it essential for entrepreneurs to stay abreast of any evolving licensing regulations, thereby ensuring a smoother company formation process.

Tax Registration and Compliance

In Laos, tax registration and compliance are foundational elements for any newly established company. To officially commence operations, businesses must obtain a Tax Identification Number (TIN) from the Ministry of Finance. This process is typically facilitated through the Department of Taxation, which requires the submission of specific documentation, including the company’s business license, articles of incorporation, and identification documents of the owners or directors. Obtaining a TIN is vital as it not only legitimizes the business but also allows the company to fulfill its tax obligations and engage in transactions with other entities.

Once registered, organizations in Laos are subject to various types of taxes. The primary tax levied on businesses is the Profit Tax, which is applicable based on the company’s income. Laos also enforces a Value Added Tax (VAT) that is imposed at the rate of 10% on the sale of goods and services. Additionally, there are specific taxes related to payroll, property, and import duties, depending on the business operations. Understanding these tax structures is crucial for compliance and effective financial management.

Ongoing compliance obligations demand that companies maintain accurate accounting records, submit annual tax returns, and ensure timely payments of any applicable taxes. It’s important for businesses to establish a rigorous accounting system that meets both local regulations and international standards. Companies may also be required to undergo periodic tax audits by the Department of Taxation to assess compliance with tax laws. Non-compliance can lead to severe penalties, making it paramount for business owners to stay abreast of changing tax policies and handle their tax affairs diligently.

The significance of adhering to tax registration and compliance cannot be overstated, as it ensures that businesses operate within the legal framework and contributes to the overall economic development of Laos.

Typical Timelines for Company Formation

The process of company formation in Laos involves several stages, each with its own estimated timeline. Understanding the typical durations associated with these stages can help prospective entrepreneurs plan effectively. Generally, the initial stage of registering a company can take anywhere from one to two weeks. This first step includes gathering necessary documentation and submitting the application to the Ministry of Industry and Commerce (MIC) for review. It is crucial to ensure that all documents are accurate and in compliance with local regulations to avoid delays.

Once the company is registered, obtaining relevant permits and licenses is the next step. This phase can vary significantly based on the type of business and specific industry requirements. For instance, businesses involved in sectors such as manufacturing or hospitality may require additional approvals, which can extend the timeline from a few weeks to several months. Typically, the licensing process is expected to take around four to six weeks, depending on the responsiveness of the regulatory agencies involved and the completeness of the application documentation.

After acquiring the necessary permits, the final phase consists of setting up the company’s operational framework, which includes opening bank accounts, enrolling employees, and fulfilling tax registration. This stage usually takes another two weeks to a month. Factors such as the efficiency of financial institutions and the promptness in securing employee documentation may affect the duration of this process. Overall, entrepreneurs should anticipate a total timeframe of two to six months for company formation in Laos, depending on the complexity of their business model and the capacity of regulatory bodies to process applications swiftly.

Challenges and Considerations for Foreign Investors

Establishing a business as a foreign investor in Laos can be both exciting and challenging. One of the primary hurdles encountered is the bureaucratic landscape. The process of navigating through various government regulations and obtaining the necessary permits can be quite complex. Investors often find that requirements may not be clearly communicated, leading to potential delays and misunderstandings. Ensuring compliance with local laws necessitates a thorough understanding of the regulatory framework governing business operations in the country.

Another critical consideration is the cultural dynamics in Laos. Foreign investors may find cultural norms significantly different from what they are accustomed to. Understanding the local customs, traditions, and business etiquette is essential for building positive relationships with stakeholders and employees. It is advisable for investors to invest time in learning the Lao language and engaging with the local community to facilitate smoother business interactions.

Legal complexities also pose a challenge for foreign investors in Laos. The legal framework can be intricate, with frequent changes in laws and regulations that affect business operations. Seeking advice from legal professionals with expertise in Lao business law is crucial to mitigate risks associated with non-compliance. Investors must also be aware of the limitations on foreign ownership and ensure that their investments are structured in accordance with local laws.

To navigate these challenges effectively, foreign investors are encouraged to adopt a cautious approach. Conducting thorough market research, engaging local partners, and seeking professional assistance can enhance the likelihood of a successful company formation. Building a network of reliable contacts within the business community can also serve as a valuable resource in overcoming potential obstacles and fostering a robust operational foundation in Laos.

Conclusion and Next Steps

Establishing a company in Laos presents unique opportunities along with a set of challenges that prospective business owners must navigate. This guide has outlined the essential steps involved in company formation in Laos, including understanding the regulatory requirements, the importance of local partnerships, and the need to adhere to industry-specific regulations. It is crucial for entrepreneurs to recognize that thorough preparation can significantly impact their success in this emerging market.

As you consider launching a business in Laos, the first step should involve consulting with legal experts who specialize in Laotian business regulations. Local legal counsel can provide invaluable insights and help you understand the complexities of the legal landscape, ensuring compliance with local laws and regulations during the formation process. Their expertise can help you avoid potential pitfalls and streamline your business setup.

Additionally, conducting thorough market research is essential. Understanding the local market dynamics, consumer behavior, and competitive landscape will enable you to identify niche opportunities that align with your business objectives. Comprehensive research assists in refining your offering and is instrumental in creating a viable value proposition that resonates with Laotian consumers.

Finally, developing a strategic business plan cannot be overlooked. This document should detail your business goals, target market, operational strategies, and financial projections. A robust business plan not only serves as a roadmap for your operations but is also beneficial for securing financing, should you require capital investments. By meticulously planning your approach, you will elevate your chances of establishing a successful venture in Laos.

In conclusion, by following the steps outlined in this guide and equipping yourself with the necessary knowledge and support, you will be well-prepared to embark on your journey of company formation in Laos. Armed with insight and strategic planning, you can position your business for sustainable growth in this developing economy.