S corporations and LLCs are distinct parts of corporate operations, yet they are not mutually exclusive. Learn more about the differences between an LLC and a S corporation by using this tutorial.

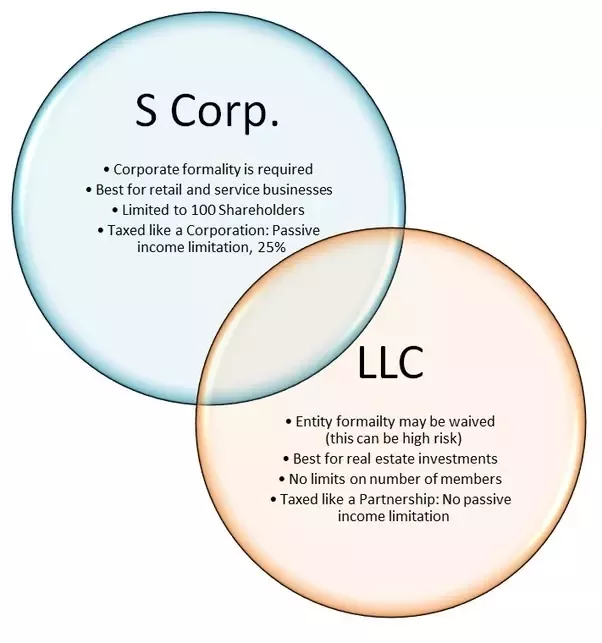

The terms limited liability companies (LLCs) and S (Subchapter) corporations are sometimes used interchangeably, although this is incorrect. The distinction between an LLC and a S corporation is that an LLC is a commercial entity, while a S corporation is a tax categorization.

Whether you’re considering forming an LLC or forming a S corporation, starting a company is an exciting endeavour full of learning opportunities. This tutorial may help you understand the distinctions between LLCs and S companies so you can make the right option for your company.

Table of Contents

What Exactly Is an LLC?

A limited liability corporation (LLC) is a legal entity that may shield small-enterprise owners from personal responsibility in commercial commitments. Members are the owners of LLCs. LLCs may have a single owner (single member LLC) or several owners (multi-member LLC). LLC owner-employees are self-employed.

LLCs provide a formal company structure while also being taxed in the same way as sole proprietorships or partnerships. In terms of structure and profit sharing, an LLC is more adaptable than a corporation. An LLC may also choose to be taxed as a corporation, and shareholders can save money by opting for S corp. tax status.

What Exactly Is a S Corp.?

An S company is a tax categorization that may shield the assets of small-business owners from double taxation. An S corporation uses pass-through taxes, which means that the owner claims a portion of the company’s income on their personal tax return. This prevents earnings from being taxed twice (once under the corporation and again under the owner).

Because a S corp. is a subchapter corporation, the “S” in S corp. stands for “subchapter.” When you incorporate a corporation, you will first create a C corp., which must fulfil S corp. standards in order to be designated as such. The prerequisites include adopting S corporation status two months and fifteen days after legally incorporating your firm (for the status to apply to the current tax year), capping ownership at 100 people (not companies or partnerships), and restricting those owner shares to U.S. residents exclusively. If you incorporate an LLC, you must additionally submit IRS Form 2553 to choose a tax classification.

Owners of S corporations may work for the firm. Owner-employees must pay themselves a fair wage for their efforts. On such compensation, they will pay federal and state income taxes, Medicare tax, and Social Security tax. Owners earn extra profits in the form of distributions, which are exempt from Medicare and Social Security taxes.

What Is the Distinction Between a S Corp. and an LLC?

As previously stated, a S corp. is a tax classification, but an LLC is a commercial entity. This indicates that an LLC may get S corp. status provided specific conditions are met. LLCs and S companies, on the other hand, have various management and shareholder structures, as well as varied reporting obligations. These distinctions will be discussed more below.

Employment Opportunities for Owners

S companies may employ and compensate its owners. An LLC considered as a company may also pay its owners a salary. If your LLC profits after paying owners a fair wage, you may be able to save money on taxes by adopting S company taxation.

Important Takeaways:

The owner of a S corporation might remain hands-off or accept a salary as a corporate employee LLC. The owner has the option of being hands-off or participating in the operation of the company.

Structure of Ownership

By default, an LLC functions similarly to a sole proprietorship or partnership. An LLC, on the other hand, may have an infinite number of owners (members) from all over the globe; these owners can even be another corporate organisation.

An S corporation must be a U.S. company controlled by U.S. citizens and cannot have more than 100 shareholders. S companies, in addition to people, restrict ownership to trusts and estates.

Important Takeaways:

S Corp. 100 or less owners; must be U.S. citizens or trusts domiciled in the United States LLC. There are no limits on categorization or country for unlimited owners.

Structure of Management

A company has a board of directors that makes high-level business decisions. Shareholders are in charge of choosing directors to the board of directors. Outside of the board of directors’ duties, officer positions such as president, vice president, and treasurer exist to handle everyday corporate operations.

Managers, not directors, operate LLCs. Owners may engage in management (a member-managed LLC) or pay managers to handle the duties (a manager-managed LLC). An LLC may also elect to select officers if such structure makes sense in the context of the business strategy.

Important Takeaways:

S Corp.: Shareholders elect a board of directors; executives oversee day-to-day operations.

Managers handle the day-to-day activities and may designate officials if necessary.

Shareholders and Stock

An S corporation may only issue common stock, which entitles shareholders to vote. An LLC cannot issue stock and does not have shareholders; instead, members must be paid in accordance with the LLC’s articles of incorporation. If you choose to establish your LLC as a S corporation, you will be unable to issue shares.

Important Takeaways:

S Corp. Common stock with voting rights for shareholders LLC There is no stock or shareholders at all.

Tax Responsibilities and Reporting Requirements

The standard taxation of LLCs is similar to that of sole proprietorships (for single-member LLCs) and partnerships (for multi-member LLCs). If they fulfil the qualifying conditions, single- and multi-member LLCs may also opt to be taxed as C corporations or S companies. Non-S corp. LLC owners must pay a self-employment tax of 15.3 percent on all net profits*.

S companies are subject to less tax and reporting obligations than C businesses. An S corporation is not subject to corporate income tax, and all earnings are distributed to the shareholders. A C corporation must pay weekly taxes in addition to yearly income taxes on their portion of the earnings.

Important Takeaways:

S Corporation: The owner may accept a salary while avoiding self-employment taxes on the remainder of the earnings.

If the LLC is taxed as a sole proprietorship or partnership, the owner must pay self-employment tax on any net income.

The cost of establishing

The expense of forming an LLC and choosing a S corp. Status might change based on where you reside and if you do business over state boundaries. Legal counsel may cost you more, but it will most likely save you money and time while assisting you in avoiding typical blunders.

The typical cost of filing articles of incorporation, excluding attorney expenses, varies from $100 to $250*, depending on the state in which you file. Depending on the state, the cost of forming an LLC is between $50 and $500. If you do business in other states as an LLC, you must register to do so in each of those states, which will incur a foreign business registration charge.

Important Takeaways:

Fees for forming a S company vary from $100 to $250.

LLC creation costs vary per state, ranging from $50 to $500.

- LLC S Corporation: Which Is the Best Option for You?

LLCs and S corporations are two types of company structures. Choosing one, both, or neither categorization might help your firm in a variety of ways. When operating a company, analyse your demands and ask yourself the following questions to obtain a better sense of which classification is best for you.

How many owners do you have in your company?

Are all of your business partners citizens of the United States?

Is your company owned by a partnership or a corporation?

What effect would a self-employment tax have on your net profit?

The answers to these questions may assist you in determining if an LLC designation or S corp—classification is appropriate for your company. We’ll look at how the different responses could effect you and your earnings further down.

If you want to grow your firm, a S Corp. tax classification may be appropriate for you. S companies need extra tax forms and payroll systems, which may be inconvenient if your company breaks even or generates a little profit. You may also contribute more money to retirement programmes and position your company for development by becoming a S corporation.

Separately, if your firm has constant development, a S corporation may be the best option for you. A 15.3 percent self-employment tax assessed on an LLC’s income is a significant tax duty to bear when revenues start to rise.

If you are worried about personal responsibility but desire minimum company maintenance, an LLC may be the best option for you. The legal regulations governing the construction of an LLC are less stringent than those governing the maintenance of corporations.

An LLC’s reporting obligations are often easier than those of a corporation. A limited liability company (LLC) may have an infinite number of owners. LLCs may be owned or partly owned by partnerships, companies, or noncitizens. The LLC should submit an annual or biannual report that includes information on existing members, company locations, and other changes.

Common Questions and Answers

Check out these commonly asked questions to help you determine the best structure for your needs.

Which is preferable for tax purposes: an LLC or a S Corp?

S companies pay lower taxes than non-S corporation LLCs. As an LLC owner, you would have to pay self-employment taxes on all net profits from your firm, while a S corporation would only have to pay such taxes on the salary you get from your company.

However, itemised deductions may make an LLC a more profitable tax decision. LLC owners may get tax advantages for employing a spouse or minor dependant, and they can transfer ownership of firm property without paying any extra taxes.

Why Would I Form a S Corporation?

If your company’s structure enlists a large number of workers to carry out the company’s operations, you may want to consider a S corp. classification. A board of directors is responsible for overseeing corporate choices and may rein in wayward individuals or reject actions that might hurt the firm.

Should I Form a S Corporation for My Limited Liability Company?

If your LLC is profitable or expects to be soon, you might pursue S corp. status. This permits profits to flow through the firm and into your pocket without subjecting you to a heavy self-employment tax on all net earnings.

Personal liability protection is provided by both LLCs and S companies, which cover your personal assets. When launching a company, it’s critical to plan ahead of time and anticipate the kind of development you want to attain. Your objectives and ambitions may influence which company entity and tax classes are best for you.

Copy and paste this <iframe> into your site. It renders a lightweight card.

Preview loads from ?cta_embed=1 on this post.